North Korean tungsten (chemical symbol W) has been identified as a key mineral in trade with China. Tungsten alloys are widely used in military weapons and equipment, raising concerns about their exclusion from sanctions against North Korea.

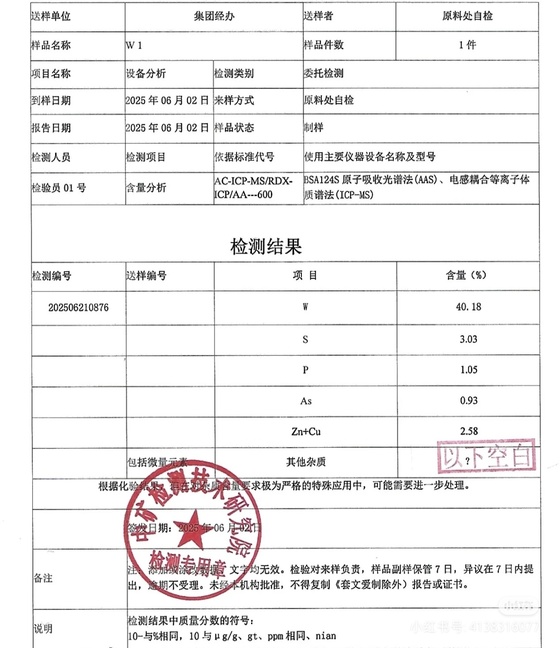

A Chinese trader who began brokering trade between North Korea and China this year posted a purity inspection report for North Korean tungsten on social media on Tuesday.

The trader received results about two weeks after submitting a North Korean tungsten sample, which arrived on June 2, to the China Mineral Inspection Technology Research Institute. The report showed W at 40.18%, sulfur (S) at 3.03%, phosphorus (P) at 1.05%, and arsenic (As) at 0.93%. Other impurities require in-depth processing due to the need for strict special operations.

Since late last year, the trader has been posting order proposals from North Korea, including minerals, outdated computer parts, and health supplements.

The contract states that all unspecified conditions are subject to the 2010 principles of the International Institute for the Unification of Private Law (UNIDROIT) and North Korean law. Arbitration, if needed, would be handled by a North Korean trade arbitration body. UNIDROIT principles govern the return of looted or illegally exported cultural property.

North Korea has been a significant tungsten exporter to China. The Korea International Trade Association reported that tungsten ore was North Korea’s second-largest export to China in the first half of last year, valued at $ 13.5 million and accounting for 7.7% of total exports. Chinese customs data showed North Korean tungsten held a 44.5% market share of China’s imports from January to October 2022.

The U.S. Geological Survey reports that as of 2024, China produces 67,000 tons (84%) of the global 81,000-ton tungsten output. Rising production costs have prompted China to import from lower-cost sources, such as North Korea and Myanmar.

Tungsten, the metal with the highest melting point, is prized for its hardness, density, and conductivity. Its durability makes it crucial for advanced industries, including defense, automotive, semiconductor, and cutting tool applications. However, it remains excluded from North Korea sanctions.

The United Nations (UN) Security Council Resolution 2371 in August 2017 banned North Korean exports of coal, iron, and iron ore. Resolution 2397 in December 2017 expanded this to include HS Code 25 items, effectively halting most mineral exports.

Tungsten ore, classified under HS Code 26 as ore, slag, is not technically sanctioned. The reasons for this exemption remain unclear.

The U.S. 2022 Reshoring Act aims to ban Chinese tungsten in defense industries by 2026 and complete domestic stockpiling by the end of this year.

In retaliation for the U.S. President Donald Trump-era tariffs, China has reportedly reduced exports and quotas for strategic minerals, including tungsten, which may increase demand for non-sanctioned North Korean tungsten.