President Donald Trump is expanding his investment portfolio to include quantum computing firms, following his recent acquisitions in rare earth and semiconductor companies. These industries share a common thread: their strategic importance to national interests.

Earlier, Trump acquired a stake in MP Materials, a U.S. rare earth company. This move came in response to China’s export restrictions on rare earth elements, which are crucial for advanced technologies.

He also invested in Intel Corporation. With artificial intelligence (AI) becoming a hot topic on Wall Street, in-house semiconductor manufacturing capabilities are now seen as essential for maintaining AI dominance.

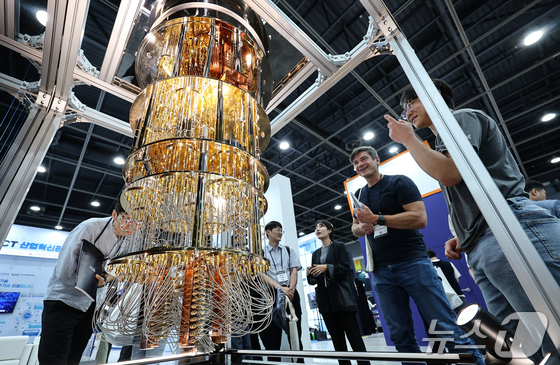

Trump is now setting his sights on quantum computing stocks. Quantum computing, a next-generation technology that far outperforms current supercomputers, is considered a key strategic industry for the future.

On October 22, The Wall Street Journal (WSJ) reported that the administration is considering acquiring stakes in quantum computing companies in exchange for federal funding.

Despite the Department of Commerce’s denial of this report, market analysts treat it as a foregone conclusion, given quantum computing’s status as a critical strategic industry.

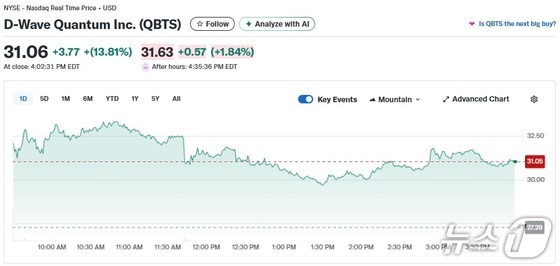

Consequently, on October 23, quantum computing stocks surged across U.S. markets. Industry leaders saw significant gains: Rigetti Computing jumped 9.80%, D-Wave Quantum soared 13.81%, IonQ rose 7.07%, and Quantum Computing climbed 7.20%.

The Trump administration appears to be aggressively pursuing a policy of government ownership in industries deemed strategically important.

In July, Trump invested 400 million USD for a 15% stake in MP Materials. This was followed by a roughly 10 billion USD investment in August to secure a 10% stake in Intel Corporation.

The WSJ reports that the U.S. government plans to invest at least 10 million USD in several quantum computing companies.