Oral obesity treatments have once again disrupted the global pharmaceutical landscape. As oral Wegovy enters full-scale distribution, the Glucagon-Like Peptide (GLP)-1 market’s focus is shifting from mere weight loss percentages to user comfort and duration of effectiveness.

With oral medications paving the way, competitors are now exploring a diverse array of delivery methods. These include monthly injections, six-month implants, nasal and sublingual films, and even ingestible capsules, all aimed at introducing obesity drugs with novel formulations.

The Oral Wegovy Revolution: From Efficacy to User Experience

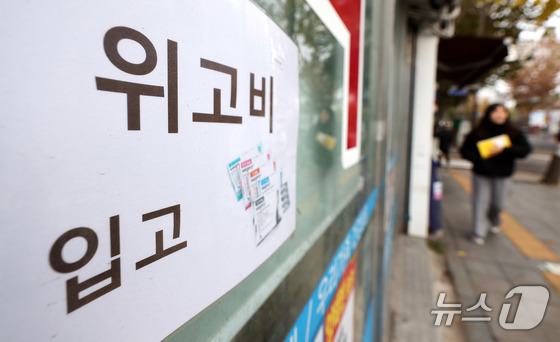

Industry sources reported on Tuesday that the Food and Drug Administration (FDA) approved Novo Nordisk’s oral Wegovy (semaglutide 25mg) on December 22, 2025. Reuters noted that clinical trials showed an average weight loss of about 16% over 64 weeks. Since its nationwide U.S. release on January 5, it has sparked a frenzy.

This development transcends the simple substitution of pills for injections. As the injectable market (weekly doses) expanded, it also highlighted challenges such as treatment barriers (injection aversion) and fatigue from prolonged use. Novo has been credited with lowering these hurdles through oral medications, potentially capturing patient groups previously unreached by injectables.

This breakthrough has accelerated the global obesity drug development and approval process. Eli Lilly, creator of Mounjaro, has submitted a New Drug Application (NDA) to the FDA for its oral small-molecule GLP-1 candidate, orforglipron.

Structure Therapeutics, a U.S. biotech firm, has gained prominence by releasing topline weight loss data from its aleniglipron clinical program.

Diversifying Delivery: Patches, Sprays, Implants, and Monthly Doses

The core of this convenience competition lies in the notion that altering the delivery method of GLP-1 essentially creates a new product. While patches are a prime example, a variety of other innovative approaches are simultaneously unfolding.

Patches lead the way, with microneedle patches at the forefront. In South Korea, pharmacokinetic (PK) data for semaglutide patches has been released, showcasing efforts to alleviate injection anxiety. Domestic companies like Daewoong Pharmaceutical are key players in this field.

Implants are also emerging as a viable option. Long-acting subcutaneous implants lasting six months are under discussion. U.S.-based Vivani Medical has unveiled plans for a six-month GLP-1 implant and announced to investors its intention to clinically develop a semaglutide implant for obesity treatment.

Monthly injections are gaining traction as well. The New England Journal of Medicine(NEJM) published results from Amgen’s monthly formulation, maridebart cafraglutide (MariTide), which garnered attention in Phase 2 trials. Ascletis has proposed a concept of developing different formulations of the same candidate, such as daily oral and monthly subcutaneous injections.

Companies are also announcing formats targeting those who find even swallowing pills challenging, such as oral dissolving films (ODFs).

Innovative delivery devices like oral capsules are emerging. These aim to deliver peptides or injectable medications, typically difficult to absorb orally, through capsule devices in the gastrointestinal tract. Rani Therapeutics has released preclinical data demonstrating oral delivery of semaglutide using its RaniPill capsule.

The focus on developing these new formulations stems from the understanding that GLP-1’s effectiveness is already established. Simply enhancing efficacy marginally won’t suffice for differentiation. Instead, improving convenience and adherence could open new patient markets and disrupt both prescription retention rates and market share.

An insider from the South Korean pharmaceutical industry noted that GLP-1 technology isn’t as novel or complex as it might seem. Given the current landscape, many believe that partnering with established firms or developing new drugs using this technology to significantly enhance convenience could create a new pillar in obesity treatments.