The South Korean pharmaceutical and biotech industry is making waves globally through innovative drug development. Once focused primarily on biosimilars, the sector has expanded into high-value novel drugs, including cancer treatments, botulinum toxins, and gastrointestinal therapies. These advancements are yielding significant results in major markets like the U.S. and China.

K-Toxin Takes on U.S. and China Markets Simultaneously: Daewoong, Huons, and Hugel Form Powerful Alliance

On Thursday, industry sources revealed that Huons BioPharma recently secured approval for its botulinum toxin product, Hutox (marketed as Liztox in Korea), from China’s National Medical Products Administration (NMPA). The company is poised to penetrate the Chinese market through strategic partnerships with local firms.

China, alongside the U.S. and Europe, is considered one of the world’s top three botulinum toxin markets, boasting an impressive annual growth rate of over 20%. Huons is laser-focused on capturing initial market share through distribution agreements with key local partners, showcasing the superior quality and competitive pricing of Korean-made toxin preparations in the Chinese market.

Hugel’s botulinum toxin product, Letybo (known as Botulax in Korea), made history as the first Korean product to receive sanitary approval in China. With the U.S. Food and Drug Administration (FDA) approval expected in the U.S. by 2024, Hugel is set to complete its entry into the Global Big 3 Markets – the U.S., China, and Europe. In China, the product’s official approval status is driving rapid market share gains, effectively displacing existing offerings.

Daewoong Pharmaceutical’s Nabota (marketed as Jeuveau in the U.S.) has seen remarkable growth since its U.S. launch, capturing over 10% of the market share. It has firmly established itself as a major player, going toe-to-toe with original drugs in the toxin market.

Daewoong is aggressively expanding beyond aesthetics into the enormous therapeutic market, which represents about 60% of the global toxin market, through strategic partnerships with local companies.

Global clinical trials for Nabota are progressing smoothly, targeting high-value indications such as chronic and episodic migraines and cervical dystonia. If successful, Nabota is poised to be re-evaluated as a blockbuster biopharmaceutical, transcending its current status as an aesthetic product.

Industry experts highlight that Korean companies have not only met but exceeded global regulatory standards, thanks to their state-of-the-art manufacturing and quality control (Current Good Manufacturing Practice) facilities. This achievement signifies that K-Bio’s manufacturing processes and quality control capabilities have reached world-class levels, moving well beyond simple product exports.

South Korea Cancer Drug Poised to Become First Global Blockbuster: The Leclaza Success Story

In the realm of severe diseases, Yuhan Corporation’s non-small cell lung cancer treatment, Leclaza (lazertinib), is making history in the Korean pharmaceutical and biotech sector. Lecrazia became the first domestically developed cancer drug to receive FDA approval in the United States, marking a significant milestone on the global stage.

Leclaza secured FDA approval as part of a combination therapy with Johnson & Johnson’s dual antibody treatment, Rybrevant (amivantamab). Its key advantage lies in overcoming resistance issues associated with existing standard treatments, positioning it to compete effectively in the first-line treatment market. The drug’s impressive efficacy in improving progression-free survival (PFS) has garnered widespread attention at international cancer conferences.

Industry experts view Lecrazia’s success as a textbook example of open innovation. Yuhan Corporation’s journey – from introducing the initial compound and conducting clinical trials to transferring the technology to global pharma giant Janssen, ultimately leading to FDA approval – serves as a blueprint for other Korean pharmaceutical companies to follow.

As Leclaza’s global sales gain momentum, the royalties flowing to Yuhan Corporation are expected to fuel a virtuous cycle of reinvestment in research and development (R&D).

@@@

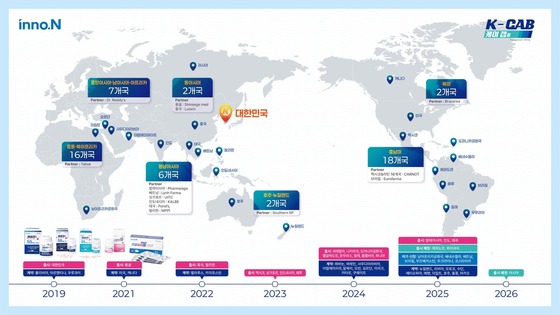

Market Entry Status of K-Cab, a P-CAB Class Drug for Gastroesophageal Reflux Disease (Provided by HK inno.N) / News1

Gastrointestinal Treatment Game-Changer: K-Cab Spearheads the P-CAB Revolution

In the chronic disease market, HK inno.N’s gastroesophageal reflux disease treatment, K-Cab (tegoprazan), is making significant strides. HK inno.N, in collaboration with its U.S. partner Sebela, has submitted a new drug application for K-Cab to the FDA.

K-Cab represents a breakthrough in the Potassium-Competitive Acid Blocker (P-CAB) class, addressing the limitations of existing proton pump inhibitors (PPIs), such as delayed onset of action and dietary restrictions.

The U.S., as the world’s largest pharmaceutical market, is seeing a steady increase in demand for gastrointestinal treatments. With P-CAB agents emerging as the next-generation standard, K-Cab is well-positioned for growth upon approval.

From its early development stages, K-Cab has been strategically accumulating clinical data with global markets in mind. FDA approval could trigger a significant reassessment of K-Cab’s market value.

Since its Korean launch in March 2019, K-Cab has achieved cumulative prescriptions worth 923.3 billion KRW (approximately 627 million USD), maintaining its position as the top prescription drug for peptic ulcers in Korea. The company has secured technology export or finished product export agreements with 55 countries, with approvals in 22 countries and launches in 19.

In China, K-Cab has received product approval and launched through local partner Luoxin Pharmaceutical, rapidly gaining market share.

An industry spokesperson noted that the Korean pharmaceutical and biotech sector has evolved beyond demonstrating high-quality manufacturing capabilities. It is now influencing major global markets through innovative drugs. The proven technological prowess and commercialization skills in the U.S. and Chinese markets will serve as a springboard for the next generation of novel drugs to succeed internationally.