Hyundai Motor and Kia have entered a new era, surpassing a combined sales of about 225 billion USD. Despite a temporary lull in electric vehicle demand, both automakers delivered robust performance. Their success stems from a strategic focus on high-margin vehicles, including hybrid models, SUVs, and the luxury Genesis line. However, the impact of U.S. tariffs has taken its toll, with operating profits declining by more than 20% compared with the previous year.

Industry experts predict that the pressure from U.S. tariffs will persist in the coming year. The automakers also face a challenging business landscape marked by macroeconomic uncertainties. In response, Hyundai and Kia are committed to fostering sustained growth through rigorous internal assessments and bold innovations to bolster their future competitiveness.

Hyundai Motor reported on Thursday that it achieved a record-breaking annual revenue of approximately 139.69 billion USD and an operating profit of USD 8.6 billion last year. This represents a 6.3% increase in revenue compared to the previous year (2024). Kia also hit a new high, posting annual revenue of USD 85.61 billion.

The combined revenue of Hyundai and Kia reached an unprecedented 225.3 billion USD, marking a 6.2% year-over-year increase. This milestone marks the first time their joint sales have exceededabout 225.1 billion USD.

However, both companies experienced significant drops in operating profits. Hyundai’s profit fell 19.5% to about 8.6 billion USD, while Kia’s fell 28.3% to 6.81 billion USD. Their combined operating profit declined from 20.18 billion USD in 2024 to 15.41 billion USD last year, a substantial 23.6% reduction.

The primary culprit behind this profit squeeze is U.S. tariffs. Hyundai and Kia reported operating losses of approximately 3.08 billion USD and 2.32 billion USD, respectively, directly attributable to these tariffs. The total impact amounts to a staggering 5.4 billion USD. Analysts estimate that without these tariffs, the automakers’ combined annual operating profit could have 20.25 billion USD.

Despite challenges, vehicle sales remained strong. Hyundai and Kia’s global sales reached 7,274,262 units last year. While Hyundai experienced a marginal 0.1% dip to 4,138,389 units, it achieved a historic milestone by surpassing 1 million wholesale units in the U.S. market for the first time. Kia outperformed expectations, selling 3,135,873 units – a 1.5% increase that set a new company record.

The sales success was driven by the Genesis brand, SUV models, and hybrid and electric vehicles. The strengthening dollar against the won also contributed positively to revenue growth.

Hyundai’s eco-friendly vehicle sales surged by 27% to 961,812 units last year. Kia followed suit with a 17.4% increase, selling 749,000 green vehicles. This growth is largely attributed to the expansion of hybrid models in key markets like the U.S., with the Palisade and Carnival hybrids leading the charge. The luxury Genesis brand captured a record 8.9% market share in the U.S.

A Hyundai spokesperson stated that the company’s ongoing efforts to optimize our product mix and maintain flexible sales strategies across various powertrains have paid off. The company exceeded our revenue growth projections while meeting our target operating profit margin.

Hyundai and Kia have set an ambitious combined global sales target of 7,508,000 units for this year. Hyundai aims to sell 4,158,000 units, while Kia targets 3,350,000—their strategy centers on tailored market responses.

Kia plans to drive growth in the U.S. market through SUVs and hybrid models, introducing new vehicles like the Telluride and Seltos. In Europe, the company will complete its electric vehicle lineup with models ranging from EV2 to EV5. For the Indian market, Kia aims to solidify its position by targeting premium SUV consumers with the launch of the new Seltos.

However, the specter of U.S. tariffs continues to loom large. Lee Seung Jo, Hyundai’s chief financial officer, expects the tariff burden to remain comparable to last year’s levels. The U.S. initially imposed a 25% tariff on Korean-made vehicles last April, later adjusting it to 15% in November. With the 15% rate continuing into this year, the financial impact is expected to mirror last year’s figures.

Hyundai remains committed to investing in future technologies. The company plans to allocate approximately 13.35 billion USD this year towards developing eco-friendly vehicles such as HEVs and EREVs, transitioning to software-defined vehicles (SDVs), and advancing core technologies in autonomous driving and AI. Their approach emphasizes rigorous analysis of investment outcomes to maximize efficiency.

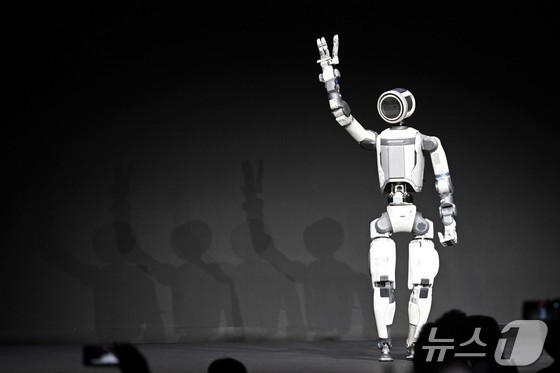

The automaker is also accelerating its efforts in humanoid robotics and autonomous driving technologies. The vice president said the company had been conducting proof-of-concept tests for its humanoid Meta technology since late last year, and added that it was on track to deploy a demonstration model of its smart car by the end of the year.