Initially, U.S. capital markets enthusiastically welcomed President Donald Trump, who had promised various regulatory rollbacks, as a pro-business leader.

However, just three months into his presidency, it has become evident that those expectations were misplaced.

From imposing tariffs to bashing the Federal Reserve (Fed), Trump has consistently made choices that negatively impact the markets, dragging down not only U.S. stocks but also global markets.

Immediately after taking office, Trump unleashed a wave of tariffs on countries worldwide. Consequently, U.S. stocks plummeted in the first quarter. The Dow Jones Industrial Average (Dow) dropped 1.28%, the S&P 500 fell 4.59%, and the Nasdaq plunged 10.42%. This marks the worst performance since 2022.

Notably, a massive sell-off occurred just before April 2, which Trump called Liberation Day when he imposed reciprocal tariffs on countries globally.

After April 2, news of some tariff postponements and country-specific negotiations seemed to stabilize U.S. stocks temporarily.

However, Trump has recently reignited market turmoil by bashing the Fed.

On Monday, the New York Stock Exchange saw sharp declines, with the Dow falling 2.48%, the S&P 500 dropping 2.36%, and the Nasdaq decreasing 2.55%.

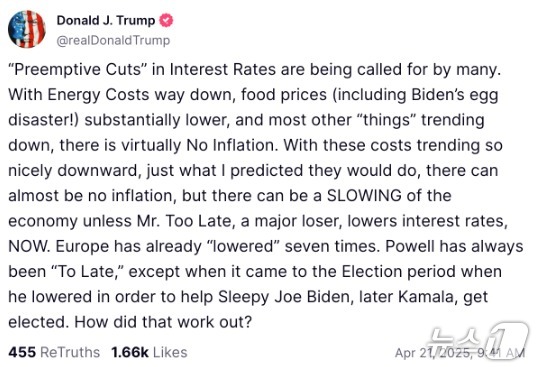

Trump referred to the Chair of the Fed, Jerome Powell, as a “Major Loser” in a social media post that day, urging preemptive interest rate cuts.

Earlier, Trump had warned Powell over the weekend that failing to cut rates could hasten economic decline.

Trump’s attacks on Powell have persisted since the Fed Chair’s speech on April 16 at the Chicago Economic Club, where he stated that he expects these tariffs will exacerbate inflation and slow economic growth, adding that the Fed is likely to face challenging scenarios.

This news triggered another wave of Sell America, causing U.S. stocks to tumble on Monday. Subsequently, Asian stock markets opened lower, with the Nikkei 225 down 0.25% and the Korea Composite Stock Price Index (KOSPI) falling 0.29%.

Trump’s combination of tariffs and attacks on the Fed continues to drag down global markets daily. At this point, it wouldn’t be an exaggeration to say that Trump has become the biggest threat to global market stability.