Global investment banks (IBs) are increasingly predicting that the Federal Reserve (the Fed) will cut interest rates at all three remaining Federal Open Market Committee (FOMC) meetings this year.

As expectations for a swift return to monetary easing by the Fed grow, the Bank of Korea (BOK) may also gain momentum for additional rate cuts.

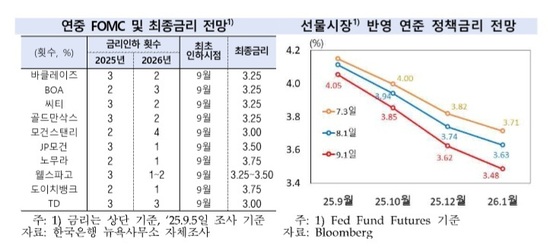

According to the BOK’s New York office, as of September 5, six out of ten major global IBs forecast three rate cuts by the Fed before year’s end. This indicates that they expect policy rate reductions at the remaining FOMC meetings in September, October, and December.

The other four banks predict two rate cuts this year. Half of these banks expect three to four cuts next year, anticipating more aggressive monetary easing than in 2023.

This sentiment is reflected in the markets. The expected year-end policy rate in federal funds futures has fallen from 3.82% in early July to 3.62% in early September—a 0.2 percentage point drop. This suggests that at least one additional rate cut is already priced in.

Shifting U.S. Economic Landscape Increases Need for Monetary Easing

The increase in expected Fed rate cuts this year is driven by recent U.S. economic indicators.

Previously, IBs had tempered rate cut expectations due to robust employment figures and persistent inflation. However, recent data shows significant downward revisions in employment numbers along with signs of easing inflation, creating a more favorable backdrop for monetary loosening.

Notably, on Tuesday, the annual benchmark revision of U.S. employment statistics revealed that non-farm payroll (NFP) figures from Q2 2022 to Q1 2023 were revised downward by 911,000 (-0.6%), equating to an average monthly decrease of about 76,000 jobs.

Citigroup estimates that if this trend of overstating non-farm payrolls continues, the current monthly employment (three-month moving average) could be negative 47,000. Although they believe this revision is insufficient to trigger a big cut (0.5 percentage point) in September, it might prompt Fed Chair Jerome Powell to hint at further rate cuts.

Bloomberg noted that this is the largest employment revision since 2000 and marks the second consecutive year of significant downward adjustments. It suggests that job growth was substantially overestimated before the current slowdown and that last year’s employment gains fell short of even half the level required to maintain a stable unemployment rate.

They added that, when accounting for this revision, employment likely declined in August 2022, aligning with the July 2022 trigger of the Sahm Rule, a recession indicator.

Easing Interest Rate Differential Pressure: Housing Prices Key to Further Cuts

These trends are increasing the likelihood of an additional BOK rate cut in October. The central bank had maintained rates in July and August to curb overheating in the metropolitan real estate market and control rising household debt, following a cut to 2.5% in May.

If the Fed lowers rates this month and signals further cuts, the BOK could relieve pressure from the record-high U.S.-Korea interest rate gap of 2 percentage points.

Nomura expects the BOK to cut rates in October and February, but notes that consecutive cuts in October and November are possible depending on domestic economic conditions.

The housing market and household debt remain critical factors. The BOK recently warned that household debt instability could persist until October, due to the lag between housing transactions and loan growth. This caution comes despite government regulatory measures and housing supply plans, as rate cuts could stimulate real estate demand and boost borrowing.

If housing prices in Seoul’s prime areas such as Gangnam and Songpa district do not stabilize, or if household loan growth fails to slow before the October 23 Monetary Policy Committee meeting, the BOK may find it difficult to implement further cuts regardless of the Fed’s actions.

Kim Chan-hee, an analyst at Shinhan Investment Corp, leans toward an October BOK rate cut but cautions that if the economy remains robust and the real estate market does not cool further, the central bank might delay cuts until November.