The Bank of Korea (BOK) has assessed that the market is increasingly considering the possibility of further interest rate cuts by the Federal Reserve, amid slowing U.S. consumption and employment.

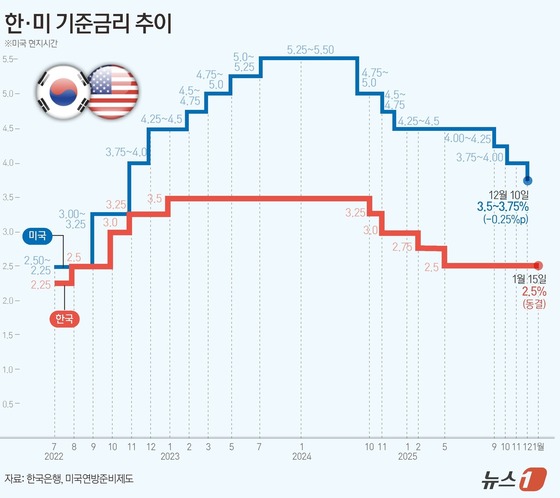

With the U.S. benchmark interest rate already at 3.75% annually, analysts predict that additional cuts could narrow the interest rate gap between South Korea and the U.S. to about 1 percentage point.

This narrowing of the interest rate differential could potentially ease the preference for dollars in the foreign exchange market, helping to alleviate the pressure of high exchange rates.

The BOK, having maintained its benchmark rate amid high exchange rate pressures, has indicated that the shrinking interest rate gap resulting from U.S. monetary easing could act as a buffer to moderate exchange rate volatility.

A report released on Sunday by the BOK’s New York office, titled “Recent (December 2025) Economic Situation and Assessment of the United States,” noted that while U.S. economic growth exceeded expectations in the third quarter of last year due to increased private spending, recent trends show a gradual slowdown in consumption. The report also highlighted a deceleration in employment growth, raising concerns about increasing downside risks to the economy.

As a result, market sentiment is leaning towards the possibility of further monetary policy easing by the Federal Reserve.

The report revealed that U.S. household credit card spending in November remained flat month over month at 0.0%. Growth in goods consumption slowed, while service consumption turned negative, clearly indicating a broader consumption slowdown.

The U.S. Consumer Confidence Index also fell to 89.1 in December from 92.9 in the previous month. The index reflecting current economic conditions dropped from 126.3 in November to 116.8 in December, while the expectations index declined from 70.7 to 70.0. These figures suggest weakening consumer sentiment and diminishing optimism about future economic prospects.

The labor market has continued to show signs of cooling. The BOK noted that despite a falling unemployment rate, job growth has been limited, with employment figures for the previous two months revised downward, indicating an ongoing deceleration.

Furthermore, December’s U.S. non-farm payrolls increased by only 50,000 jobs, falling short of the market’s 70,000 expectation. Rising new unemployment claims have added to the downward pressure on the labor market.

In light of these developments, the market is increasingly considering the possibility of further Federal Reserve interest rate cuts. The report explained that although the Fed has signaled caution about future rate cuts, its quicker-than-anticipated implementation of reserve management purchases (RMP) and Chair Powell’s emphasis on labor-market slowdown risks over inflation concerns have been interpreted as a generally dovish stance.

Major investment banks forecast that the Fed will likely cut its benchmark rate by an additional 0.25 to 0.75 percentage points this year in response to the labor market slowdown. Consequently, the financial market’s projected interest rate path for this year has been slightly adjusted downward by 0.02 percentage points.

BOK Governor Lee Chang Yong suggested that if the U.S. cuts interest rates, the gap between South Korean and U.S. rates could narrow more rapidly.

The BOK also expressed its view that the narrowing interest rate gap due to U.S. monetary easing could serve as a buffer to stabilize exchange rate volatility.

The BOK’s benchmark interest rate, set on Thursday, stands at 2.50%, resulting in an interest rate gap of approximately 1.25 percentage points with the U.S. At that time, five out of six members of the Monetary Policy Committee favored keeping the rate unchanged for the next three months, while one member suggested maintaining flexibility for a potential rate cut. This context implies a prevailing view that the current interest rate level should be maintained.

If the BOK maintains its rate and the Fed cuts its benchmark rate by 0.25 percentage points, the interest rate gap would narrow to 1.0 percentage points. A 0.75 percentage point cut would reduce it to 0.5 percentage points.

Experts believe that such a narrowing of the interest rate gap could help buffer the high exchange rate trend.

Yoon Yeo Sam, an analyst at Meritz Securities, said that if U.S. interest rates are cut by an additional 0.25 to 0.75 percentage points, as markets expect, the resulting narrowing of the external interest rate gap could affect capital flows. He noted that historically, when the interest rate differential between South Korea and the U.S. was within 100 basis points, the exchange rate tended to hover around 1,200 KRW per dollar.

He added that while lower interest rates generally benefit companies with high debt ratios, this does not automatically lead to rising stock prices. Likewise, he emphasized that a narrowing interest rate gap should be seen as moderating the speed and volatility of the strong exchange rate trend rather than directly pushing the exchange rate lower.

However, Yoon cautioned that current pressures for capital outflows are much stronger than in the past, making it unlikely for the exchange rate to return to previous levels solely due to the narrowing external interest rate gap. He explained that the interest rate gap primarily supports the stability of interest-bearing assets like bonds, which can positively influence expectations about economic fundamentals.

This assessment aligns with remarks by Bank of Korea Governor Lee Chang Yong. At a press conference following a Monetary Policy Committee meeting, he said that even if South Korea adjusts its rates gradually, the interest rate gap with the U.S. would continue to narrow if the U.S. lowered its own rates.

This suggests that, rather than rushing to cut rates amid high exchange rates, the BOK views changes in external monetary policy as a buffer to stabilize exchange rate fluctuations.