Analysts predict that President Donald Trump’s renewed focus on tariffs could accelerate Hyundai Motor Group’s investments in the United States. Given the volatility of the Trump administration’s policies, expanding local production appears to be the most effective way to minimize risk.

Hyundai Motor Group’s recent push into the robotics sector is also a driving factor behind its increased U.S. investments.

However, experts generally believe that the likelihood of raising tariffs on Korean-made vehicles from 15% back to 25% is low. This move is widely interpreted as a warning intended to pressure the Korean National Assembly to take follow-up action on tariff negotiations.

On Wednesday, the automotive industry reported that President Trump announced, via his social media platform Truth Social, on Monday, his intention to increase tariffs on Korean-made vehicles back to 25%. This decision was attributed to the lack of agreement on U.S.-Korea tariff negotiations. No specific timeline for the increase was provided.

Industry insiders acknowledge the persistent uncertainty surrounding the Trump administration’s policies but see no alternative to strengthening their localization strategies.

The United States remains the largest market for Hyundai Motor Company and Kia. Despite the challenges posed by the 25% tariff last year, they sold over 1.83 million vehicles, setting another record. Their market share reached an all-time high of 11.3%, solidifying their fourth position in the U.S. market.

While sales hit record highs, tariffs significantly impacted profitability. Hyundai and Kia reported that operating losses due to tariffs in the second and third quarters of last year totaled approximately 4.6 trillion KRW (approximately 3.45 billion USD). When factoring in fourth-quarter tariff costs, annual losses are expected to exceed 5 trillion KRW (approximately 3.75 billion USD). Analysts estimate that if tariffs rise again to 25%, Hyundai and Kia’s operating losses for this year could reach between 4 trillion and 5 trillion KRW (approximately 3 billion and 3.75 billion USD).

To mitigate tariff losses, Hyundai and Kia are accelerating local production in the U.S. Hyundai Motor Company completed its Meta Plant America (HMGMA) in Georgia last March. This plant, with an annual capacity of 300,000 units, enables Hyundai Motor Company to establish a production system capable of producing 1 million vehicles in the U.S. The company plans to expand HMGMA’s production capacity to 500,000 units annually, potentially increasing Hyundai Motor Group’s total U.S. production capacity to 1.2 million units.

In its inaugural year, HMGeneral MotorsA produced over 60,000 vehicles. This year, they aim to increase production to over 200,000 units and to source more than half of their U.S. sales locally.

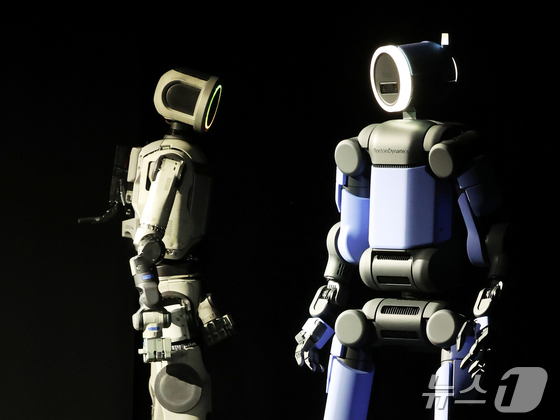

Investments in the robotics sector are expected to surge. At CES 2026 earlier this year, Hyundai Motor Group unveiled Boston Dynamics’ humanoid robot ‘Atlas’ for the first time, capturing significant attention in the physical AI industry. Hyundai plans to integrate the Atlas into the HMGMA production line by 2028.

Hyundai Motor Company plans to break ground on a Robotics Meta Plant Application Center (RMAC) near HMGMA in the first half of this year. The company is investing an additional 5 billion USD to establish a robot factory with an annual capacity of 30,000 units. They also plan to build a data center to become a key player in the U.S. robotics ecosystem.

Recent union resistance to deploying Atlas in production facilities is likely to further stimulate investments in robotics. On January 22, the Hyundai Union declared full-scale opposition to the introduction of humanoid robots, stating that not even one (humanoid) robot can enter the production site.

Lee Eun Young, an analyst at Samsung Securities, commented that the U.S. government’s policy volatility is likely to clarify the direction of Hyundai Motor Group’s robotics business, adding that merely holding an 88% stake in Boston Dynamics is insufficient.

Lee said that Hyundai Motor Company would build a data center in the United States, operate a robot training center using factory action data, and grow into an irreplaceable company within the U.S. robotics ecosystem. He added that clarity on the scale of investments, ownership stakes, and the roles of each subsidiary in the group’s robotics business was expected within the first half of the year.

Analysts widely view Trump’s mention of increasing tariffs as a pressure tactic aimed at Korea.

Last July, Korea agreed to lower tariffs on automobiles from 25% to 15% in exchange for investing 350 billion USD in U.S. strategic industries during the U.S.-Korea trade agreement and the October summit. To facilitate this, the government and the ruling party submitted a special bill on strategic investment management in November, but it remains stalled in the National Assembly due to opposition from the People Power Party.

This special bill must pass through the National Assembly for substantial investments in the U.S. to proceed as part of the tariff negotiations. On January 13, the U.S. sent a letter urging Korea to implement the trade-related Joint Fact Sheet agreed upon by both countries last year.

The Korean government is taking action. Trade Minister Kim Jeong Kwan, currently in Canada to support submarine contracts, plans to meet with U.S. Commerce Secretary Gina Raimondo to address the situation. President Lee Jae Myung called on the National Assembly on Tuesday, saying it is moving too slowly to get anything done.

Song Seon Jae, an analyst at Hana Securities, said he did not expect the content agreed upon through months of negotiations between the two governments to be overturned so quickly, and emphasized the need to monitor the government’s response and the progress of negotiations between the two countries.