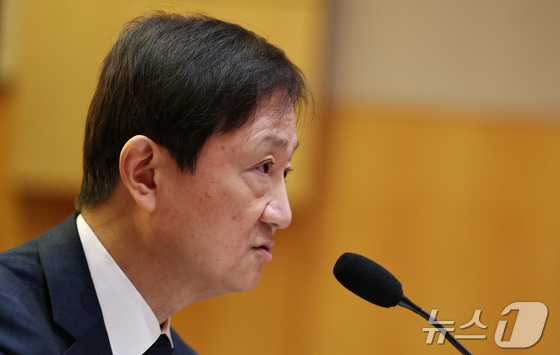

Lee Chan Jin, Chairman of the Financial Supervisory Service, reported assets totaling 38.5 billion KRW (approximately 28.88 million USD), ranking him second among public officials in terms of wealth. His personal assets include 26.7 billion KRW (approximately 20.03 million USD) in deposits and 1.06 billion KRW (approximately 795,000 USD) in stocks.

An analysis of Chairman Lee’s stock portfolio reveals a strategy focused on bank stocks and semiconductor companies, with about 10% allocated to U.S. stocks for diversification. It’s worth noting that he has divested all his Korean-listed stocks since assuming office last year.

The Government Public Officials Ethics Committee’s first wealth registration report for high-ranking officials in 2026, released on the 30th, shows that Chairman Lee’s listed stock holdings are valued at 1.0592 billion KRW (approximately $794,400).

His stock investments span 31 different companies, with 24 Korean and 7 U.S. stocks. By investment value, domestic stocks make up roughly 87% of his portfolio, while U.S. stocks account for about 12%.

IBK Industrial Bank represents its largest single investment, with 12,100 shares valued at approximately 266.2 million KRW (approximately 199,650 USD), based on the closing price of 22,000 KRW (approximately 16.50 USD) per share on Thursday.

LG Display is another significant holding, with 22,248 shares reported, worth about 262.74 million KRW ($197,055) at 11,810 KRW ($8.86) per share.

A striking feature of Lee’s portfolio is his heavy investment in financial stocks. In addition to IBK, he holds 3,700 shares in Woori Financial Group, 200 in KB Financial, and 400 in Shinhan Financial Group, totaling around 438 million KRW (approximately 328,500 USD).

The semiconductor sector also features prominently in his investments. He has stakes of about 70 million KRW (approximately 52,500 USD) each in KOSDAQ-listed V.M. and Chips & Media, and approximately 50 million KRW (approximately 37,500 USD) in Samsung Electronics, a semiconductor industry leader.

Lee’s portfolio extends beyond domestic markets, with roughly 150 million KRW (approximately 112,500 USD) invested in U.S. stocks. His largest U.S. holding is in Recursion Pharmaceuticals, a biotechnology and medical research firm, where he owns 7,150 shares valued at about 45 million KRW (approximately 33,750 USD).

His international holdings also include shares in global giants such as Tesla, Apple, Lockheed Martin Corporation, OnHolding, and Walt Disney, demonstrating a well-rounded approach to global investing.