President Donald Trump’s recent comments on potential tariff negotiations with South Korea and his apparent acceptance of a weaker dollar have pushed the global foreign exchange market into a dollar-weakening phase. Consequently, the dollar-won exchange rate has dropped to the 1420-1430 KRW range, fueling expectations of a stronger Korean currency.

Market analysts suggest that Trump’s tariff pressure is seen more as a strategic move to push for negotiations than as an immediate policy shock, easing market concerns. Additionally, speculation about a potential change in Federal Reserve leadership is supporting expectations of continued dollar weakness in the medium to long term, further bolstering the won’s strength.

While there is some upward pressure on the exchange rate, including the U.S. Treasury’s reaffirmation of a strong dollar policy, the dollar-won exchange rate has not surged as it has in the past. Instead, it’s moving within a limited range. Market sentiment leans toward a downward stabilization of the exchange rate in the near future.

On Friday, global market research firm Trading Economics assessed that the market perceives the current tariff dispute as a negotiation risk rather than an immediate policy shock.

While Trump’s renewed tariff threats against South Korea on Tuesday briefly increased short-term uncertainty, his subsequent statement on Wednesday that Washington would resolve the issue with Seoul has eased immediate pressure, according to analysts.

Foreign exchange authorities also view the current tariff-related concerns as a short-term issue.

A Bank of Korea official, who previously studied the impact of tariff uncertainties on economic growth, stated that the current situation’s duration, intensity, and market perception are significantly less severe than in past episodes. The official noted that the government is responding relatively quickly, and the market is treating these comments as a temporary issue.

In addition to hopes for stable tariff negotiations, Trump’s recent remarks that he’s not worried about the dollar’s decline and that it hasn’t dropped too much have further supported the won’s strength.

Following these comments, the dollar index fell for four consecutive trading days, reaching around 96, its lowest level since February 2022. On Thursday, it briefly halted its decline at 96.6 before dropping another 0.3%, continuing its downward trend.

Trading Economics noted that the market interprets Trump’s comments as a signal that the administration is comfortable with a weaker dollar.

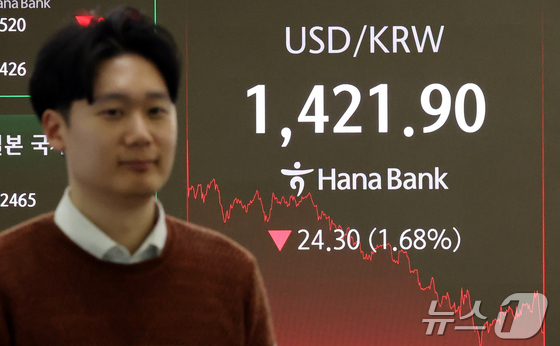

Amid this trend, the dollar-won exchange rate closed at 1422.45 KRW on Wednesday, down 23.8 KRW (1.65%) from the previous day’s closing price of 1446.25 KRW.

This marks the strongest level for the won in about three months.

Despite U.S. foreign exchange authorities denying the possibility of yen intervention and reaffirming a strong-dollar policy, the dollar-won exchange rate has not surged to the upper 1400 KRW range, as it has in the past.

Analysts interpret this as indicating that downward pressure on the exchange rate is outweighing factors that typically strengthen the dollar.

U.S. Treasury Secretary Scott Bessent, in a CNBC interview on Wednesday, emphatically denied any U.S. intervention in foreign exchange markets or efforts to strengthen the yen, stating that the U.S. has always maintained a strong dollar policy.

He added that sound policies would attract capital inflows to the U.S., reduce trade deficits, and ultimately support a stronger dollar in the long term.

This message contrasts with Trump’s earlier comments suggesting the administration’s relative comfort with a weaker dollar.

Following Bessent’s statements, the dollar index rose 0.4%, partially offsetting the previous day’s 1.2% decline, while the dollar-yen exchange rate climbed to the low 154 JPY range, indicating a weaker yen.

However, despite these dollar-strengthening factors, the dollar-won exchange rate remained relatively stable, closing at 1426.3 KRW on Thursday.

Analysts are increasingly confident that the trend of a stronger won will continue in the near term.

The Federal Reserve maintained interest rates at its first Federal Open Market Committee (FOMC) meeting of the year. Major global investment banks assessed that while the policy statement was interpreted as hawkish, Chairman Jerome Powell’s comments maintained a dovish tone, leaving room for potential further rate cuts.

However, most observers believe the meeting’s outcome will have a limited direct impact on the dollar-won exchange rate.

Market attention has shifted to the possibility of appointing the next Fed chair. Rick Rieder, Chief Investment Officer of BlackRock’s Global Fixed Income division and a leading candidate, is viewed as dovish, further increasing expectations for a weaker dollar and a potential decline in the dollar-won exchange rate.

Shinhan Bank economist Baek Seo Hhyun commented that if Rick Rieder were nominated, pressure on the dollar could intensify. She added that, given significant external pressure for a weaker dollar, the dollar-won exchange rate was likely to show a downward trend for the foreseeable future.