South Korean food brands are rapidly expanding their global presence, strengthening the status of K food through both scale and quality, with a notable shift in core overseas markets as China’s dominance wanes and the United States emerges as the primary growth engine.

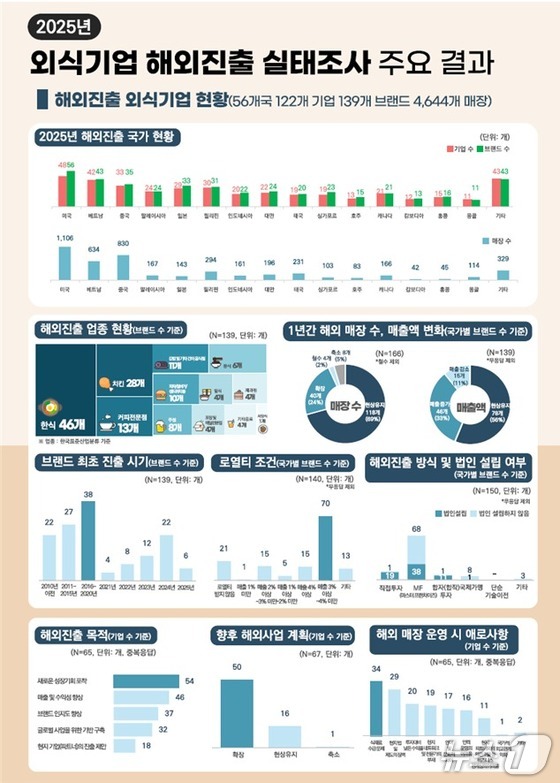

A survey released on February 5, 2026, by the Ministry of Agriculture, Food and Rural Affairs and the Korea Agro Fisheries and Food Trade Corporation found that South Korean food service companies operate 4,644 overseas stores across 56 countries including the United States, China, and Vietnam, with many firms reporting higher sales at overseas locations over the past year.

The total number of overseas stores rose from 3,722 in 2020 to 4,644 in 2025, a 24.8 percent increase, while the number of destination countries expanded from 48 to 56 despite a slight decline in the number of companies and brands entering foreign markets.

By region, the United States accounts for 23.8 percent of all overseas stores, followed by China at 17.9 percent, Vietnam at 13.7 percent, the Philippines at 6.3 percent, and Thailand at 5.0 percent, with Southeast Asia still holding the largest regional share at 36.2 percent but North America at 27.4 percent and Europe emerging as new growth frontiers.

China, which hosted 1,368 stores in 2020, is projected to fall sharply to 830 by 2025 due to intensifying local competition, while the United States has more than doubled its store count to 1,106 over the same period, marking a decisive pivot in global strategy.

Industry experts view this shift as a transition from rapid expansion in China and Southeast Asia to a profitability driven phase centered on advanced markets like the United States, where brands such as BBQ, BHC Chicken, Paris Baguette, and Tous Les Jours are leading growth in K chicken and K bakery segments.

Japan and Vietnam continue to stand out as resilient overseas markets for South Korean food brands, with Japan recording growth of more than 68 percent since 2020 as K food moves beyond Korean expatriate communities and gains strong traction among local Gen Z and Millennials amid the fourth wave of Hallyu.

Chicken restaurants, along with beverage and dessert brands, are leading expansion in Japan, and industry officials say companies that clear Japan’s high market entry barriers tend to secure stable and long term profitability.

Vietnam remains another core market, with the number of South Korean food outlets rising 37.2 percent since 2020, driven by brands such as Lotteria and Dookki Tteokbokki, which have popularized K burgers and K street food among Vietnamese consumers.

By brand category, chicken restaurants and bakeries rank first and second among overseas outlets, followed by Korean restaurants in third place, with pizza, burger, and sandwich brands forming the next tier.

Despite strong growth, companies cited ingredient supply constraints and compliance with local laws and regulations as the biggest obstacles to global expansion, prompting calls for expert support in legal, tax, and food safety requirements.

In response, the Ministry of Agriculture, Food and Rural Affairs plans to strengthen customized support across each stage of overseas expansion, including bundled programs linking food service brands with ingredient exporters and the provision of detailed market intelligence.

Jeong Kyung Seok, Director of Food Industry Policy at the ministry, said overseas expansion is not simply about opening more stores but about enhancing the global competitiveness of Korean cuisine and the broader food industry, adding that the government will provide practical, field oriented support to sustain K food growth.