Interest in SeAH Steel Holdings is growing as the company expands its footprint in the aerospace and defense sectors this year. The spotlight has intensified, particularly in light of SpaceX’s anticipated IPO, founded by Tesla’s Elon Musk.

The company’s North American SeAH Super Alloy Technology (SST) facility is slated to commence operations in the latter half of this year, promising an uptick in aerospace material supply and improved performance. However, some analysts caution that the recent stock price surge may limit further upside potential.

Industry reports on Thursday indicate that SeAH Steel Holdings’ stock closed at 75,300 KRW (approximately 56 USD) on Wednesday. While this marks a roughly 19% decline from the recent peak of 92,500 KRW (approximately 69 USD) on January 4, it remains substantially higher than early December levels when the stock began its steep ascent.

Compared with just over two months ago, when the stock traded at 28,000 KRW (approximately 21 USD) on December 5, it has surged by about 2.7 times. Moreover, it’s trading at 4.2 times its year-ago closing price of 17,980 KRW (approximately 13 USD).

The stock’s meteoric rise can be attributed primarily to the company’s robust performance last year. SeAH Steel Holdings reported consolidated operating profits of 102.4 billion KRW (about 76.8 million USD), nearly doubling with a 95.6% year-over-year increase. This performance is particularly impressive given the headwinds the steel industry faces, including low-cost imports from China and an economic slowdown.

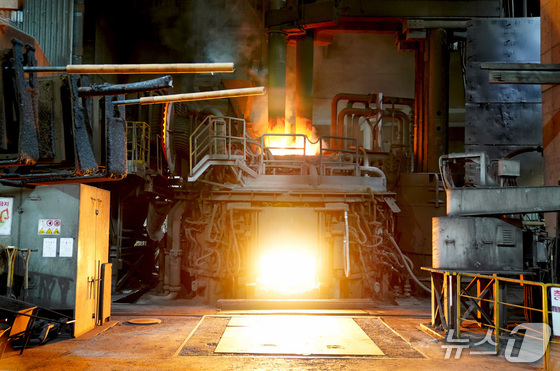

Analysts credit this success to the company’s strategic shift towards aerospace and defense materials. The subsidiary SeAH Aerospace Defense Materials posted a record profit of 24.6 billion KRW (about 18.45 million USD). Similarly, SeAH Changwon Special Steel, which has been expanding into related markets, saw its operating profit skyrocket by 789.6% to 53.9 billion KRW (about 40.43 million USD).

The growth trajectory is expected to continue this year. Financial information provider FnGuide reports a consensus forecast for SeAH Steel Holdings in 2026 of 3.8158 trillion KRW (about 2.86 billion USD) in revenue and 153.8 billion KRW (about 115.35 million USD) in operating profit. These figures represent year-over-year increases of 4.5% and 50.2%, respectively.

SeAH Steel Holdings’ expansion into aerospace and defense materials markets is cited as a key driver behind the recent stock price surge. SeAH Changwon Special Steel plans to bring its U.S. special alloy production facility, SST, online in the second half of this year. Meanwhile, SeAH Aerospace Defense Materials is investing 58.8 billion KRW (about 44.1 million USD) in a new Changnyeong plant, set to start commercial production in late 2027.

The SST project has garnered particular attention due to its alignment with SpaceX’s impending IPO. This joint venture, with a total investment of 210 billion KRW (about 157.5 million USD) from SeAH Steel Holdings, aims to produce 6,000 tons of special alloys annually once operational. Its strategic location in Texas puts it near major industry players such as SpaceX, NASA’s Johnson Space Center, and Blue Origin.

SST’s prime location in the heart of the U.S. space industry has fueled expectations that it will emerge as a key materials supplier. An industry insider said that the North American market is a key hub for aerospace and aviation, accounting for about 40% of global special-alloy demand. Reports also said that SeAH Changwon Special Steel is actively pursuing material supply agreements with SpaceX through SST.

Kwon Ji Woo, an analyst at Hanwha Investment & Securities, projects that “SST will achieve sales of 281.1 billion KRW (about 210.83 million USD) with an operating profit margin of at least 25% by 2027.” Kwon added that this year marks a pivotal moment for SeAH Steel Holdings as it transitions from a traditional steel company to a global player in aerospace, aviation, and defense materials.”

Park Kwang Rae of Shinhan Investment & Securities forecasts a strong first-quarter performance, citing multiple catalysts for stock price appreciation, including the normalization of aerospace and defense materials’ profits and revenue from SST. Park raised the target stock price for SeAH Steel Holdings to 97,000 KRW (about 73 USD).

However, some analysts suggest that the recent rapid stock price appreciation may limit further upside. Kim Hyun Tae, an analyst at BNK Investment & Securities, said the current stock price likely already reflects the potential value creation from SST. He set a target price of 74,000 won (about $56) and downgraded the recommendation to hold.