U.S. investors in Coupang have recently requested trade relief from the South Korean government due to stock losses, leading experts to predict potential hurdles for domestic fintech and retail platforms like Toss seeking U.S. listings.

On Thursday, three major Silicon Valley venture capital firms, including Greenox and Altimeter, joined Abrams Capital in initiating international investment dispute arbitration. They claim losses resulting from selective law enforcement against Coupang, disproportionate regulatory scrutiny, and defamatory false allegations.

Axios reported that Toss, valued at 7 billion USD in 2022, had aimed for a U.S. listing in Q1 this year. However, the company may delay its S-1 filing until the Coupang situation is resolved, as mounting tensions between the two countries could derail its listing plans.

This outlook stems from escalating protests by Silicon Valley venture capitalists against the government’s handling of the Coupang issue.

In late January, Coupang investors Greenox and Altimeter petitioned the U.S. Trade Representative (USTR) for trade relief, citing violations of the Korea-U.S. Free Trade Agreement (FTA) and stock price losses. Subsequently, Abrams Capital, Durabel Capital Partners, and Fox Haven Asset Management submitted letters of intent for ISDS arbitration to the South Korean government.

The combined stake of Greenox and Altimeter (3.8%) and the three companies joining the lawsuit (2.66%) totals approximately 6.46% in Coupang. The company’s stock price plummeted 37.2%, closing at 17.66 USD on Wednesday, down from $28.16 on November 28, just before the information leak incident. The estimated losses for these five companies during this period exceed 1.1 billion USD.

International media outlets report that U.S. Vice President JD Vance cautioned Prime Minister Kim Min Seok against measures that would disadvantage American tech firms like Coupang. The U.S. House Judiciary Committee’s subpoena of Harold Rogers, Coupang’s interim representative in Korea, has further impacted U.S. investor sentiment.

The long-term concern is that American investors’ perceptions of the Coupang situation could sour sentiment toward South Korean companies overall.

Industry insiders reveal that, in addition to Toss, domestic retail platforms such as Musinsa and Yanolja are exploring U.S. listings. Notably, Yanolja has reportedly appointed Goldman Sachs Group, Inc. and Morgan Stanley as underwriters, with an eye on the Nasdaq market.

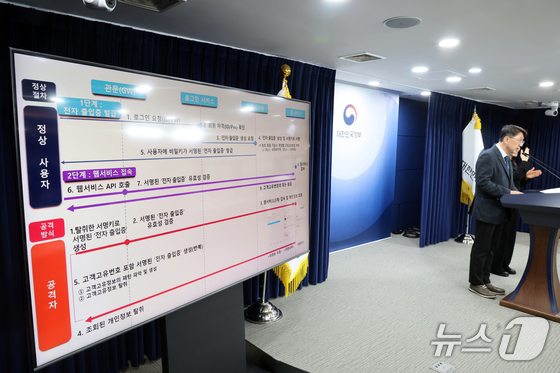

The industry is apprehensive about the prolonged Coupang situation. Following the announcement by the public-private joint investigation team, which came 70 days after the incident, various government probes, including the Personal Information Protection Commission’s fine assessments, are slated for the first half of this year.

Experts anticipate that foreign investors will increasingly view South Korea’s business environment negatively.

Professor Jeong Hyeo Sang from Kangwon National University warns that if concerns about regulatory fairness are perceived as extending beyond individual companies to entire industries, foreign investors will inevitably evaluate policy risks in the Korean market more conservatively.

Professor Kim Dae Jong from Sejong University cautioned that if South Korea’s regulations on multinational platform companies are seen as excessive, it could reinforce the perception among foreign businesses that Korea is an unpredictable market.