At the 2026 JP Morgan Healthcare Conference (JPMHC), analysts observed a shift in the biotech landscape. Improved funding prospects have emboldened companies to resist fire sales, while Chinese firms are setting new benchmarks in global technology transfer.

Domestic pharmaceutical and biotech companies are poised to carve out differentiated strategies amid mega trends like obesity treatments. To remain competitive, they’ll need to focus on maintaining high profit margins and accelerating clinical trial timelines.

Heo Hye-min, a Kiwoom Securities analyst, shared insights at a seminar on boosting overseas expansion capabilities, hosted by the Korea Pharmaceutical and Bio-Pharma Manufacturers Association on January 28. “As capital flows more freely into biotech firms, we’re seeing a reluctance to rush into sales,” Heo noted. “This is reshaping the negotiation dynamics between big pharma and biotech companies.”

Cash-infused biotechs resist bargain sales

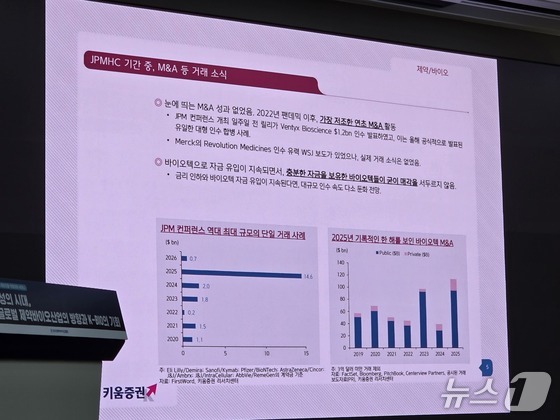

Heo attributed the slowdown in biotech M&A to improved funding conditions. While this year’s JPMHC saw strategic moves like Eli Lilly’s $1.2 billion (approximately 1.7 trillion KRW (about 1.173 billion USD)) acquisition of Biontech, mega-deals in the tens of billions were notably absent.

“2025’s record-breaking M&A activity set a high bar, but the recent surge in biotech funding – the most robust in four years – is a game-changer,” Heo explained. “With interest rate cuts on the horizon, well-funded biotechs have little incentive to sell at discounted prices. As M&A premiums soar to 100% of company valuations, even big pharma is treading more cautiously.”

China emerges as new tech transfer powerhouse; AbbVie’s move signals shift

While M&A activity cooled, the technology transfer market heated up. Fierce competition surrounded next-gen modalities like PD-1/VEGF bispecific antibodies, blood-brain barrier shuttles, and antibody-drug conjugates. Heo highlighted AbbVie’s $5.6 billion (approximately 8 trillion KRW (about 5.52 billion USD)) deal with Chinese firm Lemegen for a bispecific antibody, underscoring China’s rising prominence.

“AbbVie’s choice of Lemegen over Western alternatives is telling,” Heo remarked. “Last year, Chinese firms accounted for seven of the top ten global tech deals. It’s clear that Chinese biotech transactions are now setting industry benchmarks, supplanting Western deals.”

The obesity treatment market remains red-hot. While Novo Nordisk and Eli Lilly dominate, new entrants are vying for market share with innovative dosing strategies.

At the conference, Novo Nordisk unveiled data showing its oral Wegovy matched the 16.6% weight loss of injectable forms. Eli Lilly countered by announcing plans for its own oral formulation by 2026.

“Market leaders are doubling down on oral formulations, while newcomers like Amgen and Pfizer bet on monthly dosing,” Heo observed. “All eyes are now on how Lilly’s oral offering might disrupt the injectable market.”

K-Bio firms must leverage ‘margins and speed’ as regulatory landscape shifts

Heo views the potential easing of regulatory uncertainty under a new administration as a positive signal. He advises domestic companies to focus on niche strategies emphasizing improved margins and accelerated development timelines.

“Big pharma is hungry for high-margin pipelines amid pricing pressures,” Heo explained. “Pivoting from complex biologics to cost-effective small molecules could be a compelling way to showcase profitability potential.”

“Ultimately, a company’s value hinges on clinical speed,” Heo concluded. “If the government streamlines approval processes, we could see a renaissance for K-Bio firms with solid technological foundations.”