Celltrion is expanding its growth trajectory by leveraging its stable revenue base from its biosimilar business and gaining momentum through new drug development.

The company’s record-breaking performance last year and the acquisition of the Branchburg plant in the U.S. have sparked optimism about business expansion. This has led major global investment banks (IBs) to raise their target stock prices for Celltrion, signaling a shift in global investor sentiment.

Market analysts suggest that the potential value of Celltrion’s new drug pipeline has not yet been fully reflected in its valuation, indicating room for further growth.

This year, Celltrion aims to refine its investor relations (IR) strategy to broaden its reach among global investors and highlight its new drug pipeline, prompting a reassessment of its corporate value.

Industry sources reported on Friday that the launch of Celltrion’s new high-margin biosimilar products, including Steqeyma, Stoboclo, and Osenvelt, is fueling revenue growth and enhancing profitability. As a result, major global IBs are consistently raising their target prices.

Morgan Stanley, a leading global IB, recently upgraded Celltrion from neutral to buy, raising its target price from 202,000 KRW (approximately 151.50 USD) to 275,000 KRW (approximately 206.25 USD). The firm cited the contribution of highly profitable new biosimilars to revenue growth and projected a significant improvement in this year’s operating profit margin.

Swiss bank UBS also increased its target price from 245,000 KRW (approximately 183.75 USD) to 260,000 KRW (approximately 195 USD), maintaining a buy recommendation. They anticipate that the acquisition of the Branchburg plant will become a new growth engine for contract development and manufacturing organization (CDMO) services.

CG Securities International (CGSI) noted that Celltrion’s Q4 revenue guidance exceeded expectations and projected further revenue growth this year. They raised their target price from 220,000 KRW (approximately 165 USD) to 240,000 KRW (approximately 180 USD).

Other major global investment institutions, including HSBC and Nomura Securities, set their target prices at 250,000 KRW (approximately 187.50 USD) and 240,000 KRW (approximately 180 USD), respectively, both issuing buy recommendations.

Industry experts argue that Celltrion’s corporate value should not be limited to its biosimilar business. Given the progress in new drug development, they believe it’s time to incorporate the growth premium associated with the potential of new drugs into the company’s valuation.

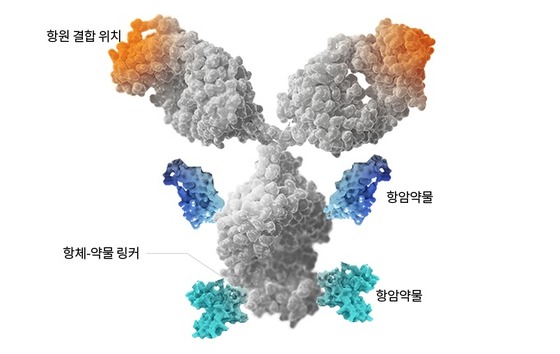

At the 2026 JP Morgan Healthcare Conference (JPMHC) on January 13, Celltrion unveiled a development roadmap for 16 new drug pipelines, including antibody-drug conjugates (ADCs), multi-antibodies, fetal Fc receptor (FcRn) inhibitors, and obesity treatments. This presentation garnered significant attention from global investors.

ADC candidates CT-P70, CT-P71, and CT-P73 have entered Phase 1 clinical trials, with key results expected to be released starting in the second half of this year. Market watchers anticipate that positive clinical data could catalyze a reevaluation of the company’s value.

The FDA recently granted fast-track designation to CT-P70, which could accelerate its development. Celltrion plans to pursue similar designations for CT-P71, CT-P72, and CT-P73.

The next-generation obesity treatment candidate CT-G32 is also drawing attention. This quadruple-action, mechanism-based candidate aims to address limitations of existing treatments, particularly individual variability in treatment effects and muscle-loss side effects, as a key differentiating strategy.

Celltrion plans to submit clinical trial plans for 12 new drug pipelines, including CT-G32, by 2028, ramping up its new drug development efforts.

Celltrion is set to broaden its engagement with global institutional investors to ensure its momentum in new drug development is reflected in its corporate value. The company has already enhanced investor access to information by promptly sharing major business strategies and new drug development roadmaps.

At key investor events such as the JPMorgan Healthcare Conference and the Jefferies Healthcare Conference, Celltrion has presented its growth strategy and conveyed its competitive edge and growth potential during overseas roadshows in major financial hubs, including Hong Kong, Singapore, London, Paris, New York, and Tokyo.

Looking ahead, Celltrion plans to expand its overseas IR activities into new regions, including Northern Europe, the Middle East, and Oceania, to continue communicating its achievements in new drug development and future growth potential to global investors.

A Celltrion spokesperson said the company was rapidly advancing new drug development through its R&D capabilities and global partnerships. The spokesperson added that it would continue to enhance communication so global investors can fully appreciate Celltrion’s future growth potential in their corporate evaluations.