Make America Great Again

Donald Trump’s campaign slogan Make America Great Again (MAGA) aimed to reclaim America’s global dominance through manufacturing and technological leadership.

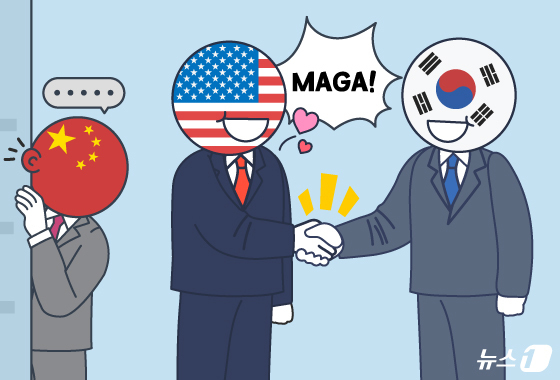

This strategy led to China’s containment and global supply chain restructuring. South Korea emerged as America’s reliable MAGA partner, boasting technological prowess and robust production infrastructure.

The U.S. pivot jolted South Korea’s stock market. KOSPI rallied as MAGA-friendly sectors like semiconductors, shipbuilding, nuclear power, and electrical equipment stocks surged.

Korea Exchange data shows KOSPI skyrocketed 71.14% from 2,399.49 points in early January to 4,106.39 on Monday, peaking at 4,226.75 on November 4.

This performance outshines global peers, eclipsing S&P 500’s 16.17%, Shenzhen Index’s 27.52%, and Nikkei 225’s 27.79% gains.

KOSPI’s rally was propelled by semiconductors, shipbuilding, defense, nuclear, and electrical equipment sectors. The KRX Semiconductor Index soared 109.56%, while KOSPI 200 Heavy Industry Index leaped 161.68% year-to-date.

Standout performers include Samsung Electronics up 93.82%, SK Hynix surging 261.57%, Hyosung Heavy Industries skyrocketing 466.79%, Doosan Enerbility climbing 333.00%, and Hanwha Ocean rising 234.92%.

Analysts attribute this rally to a demand + alliance dynamic. U.S.-China tensions, ignited by high U.S. tariffs on Chinese goods in 2018, have ballooned into tech, security, and supply chain disputes.

Trump’s MAGA agenda aggressively sidelined China from global supply chains, aiming to cement U.S.-centric supply networks and tech supremacy.

South Korea filled the void, becoming America’s go-to tech and components supplier. Korean firms are riding the artificial intelligence (AI) wave and U.S. defense buildup, particularly in semiconductors, nuclear power, electrical equipment, and shipbuilding.

Lee Jong-hyun of Kiwoom Securities notes that Korean firms stand to gain significantly as key players in the MAGA era U.S. supply chain overhaul. Opportunities abound for domestic industries as China alternatives.

The stock market reflects this shift, with capital flowing to MAGA beneficiaries. Unlike the previous cars, chemicals, and electronics rally driven by Chinese demand, this surge stems from integration into U.S.-centric tech and security supply chains.

Kim Young-il from Daishin Securities explains that the earlier rally boosted KOSPI through China trade. Now, U.S. centrism is fragmenting trade networks rather than integrating them.

As U.S.-China Cold War Persists, MAGA Stocks Poised for Further Gains

The trajectory of U.S.-China tensions will be crucial. A thaw in relations could rapidly alter the landscape.

Last month, Presidents Trump and Xi agreed to extend mutual tariff suspensions for another year.

However, structural conflicts are likely to persist. The dispute has evolved beyond trade into a battle for tech and security dominance. As power dynamics in trade, tech, and security remain critical, supply chain restructuring is expected to continue.

Post-summit, China banned U.S. chips in its AI data centers, while the U.S. restricted Nvidia’s low-spec AI chip exports to China.

Ko Tae-bong of iM Securities predicts that U.S.-China tensions will escalate from trade to security and hegemony conflicts. While temporarily eased, the situation remains volatile. The AI dominance race could persist for years.

Park Hee-chan of Mirae Asset Securities adds that the MAGA trend in the U.S. is likely to outlast Trump’s presidency.

Global supply chain reshuffling is expected to continue. Lee views it as a massive capital expenditure cycle lasting at least a decade, not a fleeting trend.

Analysts foresee continued upside for U.S. MAGA beneficiaries. However, the extent and longevity of benefits will hinge on how deeply firms integrate into U.S. supply chains. Slow adapters may see limited gains.

Jo Soo-hong of NH Investment & Securities projects that the global economy, driven by AI investments, will maintain steady U.S.-centric growth. Momentum will likely persist in AI and U.S. strategic industry value chains.