The U.S.’s decision to eliminate the endangerment finding, which served as the legal basis for greenhouse gas regulations, has drawn attention to its potential impact on South Korea’s automotive and battery industries. While this change may create a more favorable environment for internal combustion engine vehicle sales in the short term, analysts suggest that cost-saving benefits could be limited for domestic companies that have already aligned their production systems with global standards. The potential slowdown in the transition to electric vehicles is expected to introduce variables into long-term strategies.

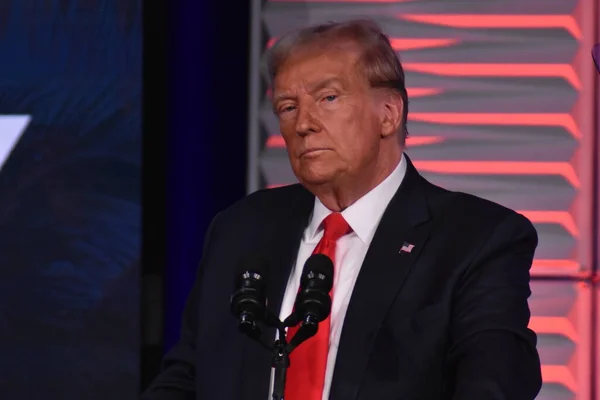

On February 12, U.S. President Donald Trump announced, in conjunction with the Environmental Protection Agency, the termination of the greenhouse gas endangerment finding implemented in 2009. This finding had been a crucial basis for regulating emissions from vehicles and power plants since the U.S. Supreme Court recognized greenhouse gases as pollutants in 2007. The White House claims this move will eliminate over 1.3 trillion USD in regulatory costs and reduce the average price of new cars by nearly 3,000 USD.

A representative from the Ministry of Trade, Industry, and Energy stated that this aligns with the policies anticipated since the beginning of Trump’s second term, particularly regarding the withdrawal from the Paris Climate Agreement. It has been considering this scenario, so it doesn’t have any immediate additional responses planned. They’re currently in a monitoring phase. The ministry views the recent changes in U.S. policy as part of a previously anticipated trend.

In the automotive industry, experts are skeptical about whether the relaxation of regulations will directly lead to reduced production costs. A ministry official explained that while lowering or eliminating U.S. emissions standards could reduce certification burdens for exports, they’ve already developed engines and equipment to meet those standards. Relaxing the standards doesn’t necessarily mean it needs to redesign or significantly lower costs. They emphasize that, given the established production lines aligned with global standards, the potential for additional cost savings is limited.

Some analysts suggest that the decision could positively affect production volumes at U.S. facilities like Hyundai’s Alabama plant. If the burden of low-emission standards decreases, it may favor the sales expansion of internal combustion engine vehicles, such as SUVs and pickup trucks. However, within the ministry, there is an assessment that the situation does not indicate a structural decrease in production costs.

Conversely, the electric vehicle and battery sectors may face significant challenges. If the U.S. government eases pressure for the transition to electric vehicles, the pace of demand growth could slow down. In fact, in the fourth quarter of last year, electric vehicle sales in the U.S. dropped to 239,021 units, a 42.4% decrease from 414,814 units in the previous quarter, indicating a slowdown. Changes in electric vehicle distribution policies could also impact the shipping strategies of battery manufacturers like LG Energy Solution, Samsung SDI, and SK On.

In the trade sector, experts view the policy uncertainty as a variable. They caution that the U.S. might reduce burdens on its domestic industries while recovering gains through other trade measures, adding that if additional actions, such as tariffs or non-tariff barriers, are implemented, the effects felt by South Korean companies could differ significantly.

Professor Koh Jong-sung from Seoul National University’s Department of Earth and Environmental Sciences commented that the termination of the endangerment finding undermines the legal and scientific foundations of regulations built on the conclusion that greenhouse gases threaten public health and welfare. If the U.S. retreats from this stance, it could destabilize international momentum for emissions reductions. This weakening of international reduction norms could increase uncertainty in the trade environment and industrial strategies.

South Korea’s regulations are not expected to change immediately in response. A representative from the Ministry of Climate, Energy, and Environment stated that the domestic legal basis similar to the U.S. endangerment finding is established in the Carbon Neutrality and Green Growth Basic Act and the Emissions Trading Act. Currently, there is no possibility of legislative changes, so the U.S. regulatory relaxation will not affect South Korea’s reduction system. Professor Hong Jin-kyu from Yonsei University’s Department of Atmospheric Sciences noted that South Korea has secured legal efficacy similar to the U.S. endangerment finding by stating in the Carbon Neutrality Basic Act that greenhouse gases threaten human survival and ecosystem safety.

Ultimately, analysts suggest that while this decision may create a short-term favorable environment for internal combustion engine vehicles, it is unlikely to fundamentally alter the cost structure for South Korean companies. The speed of the transition to electric vehicles and the direction of future U.S. policies are likely to have significant impacts across various industries.