Analysts forecast a 13-18% increase in dynamic random access memory (DRAM) prices for Q4 this year, fueled by demand for server DRAM and high-bandwidth memory (HBM).

Market research firm TrendForce reported on Wednesday that general-purpose DRAM prices are expected to climb 8-13%, while overall DRAM prices, including HBM, could surge 13-18% compared to the previous quarter.

TrendForce noted that the top three DRAM suppliers are prioritizing advanced process capacity for high-end server DRAM and HBM, leading to reduced capacity for personal computer (PC), mobile, and consumer applications. This trend is maintaining significant price increases for existing process DRAM while next-gen products show modest upticks.

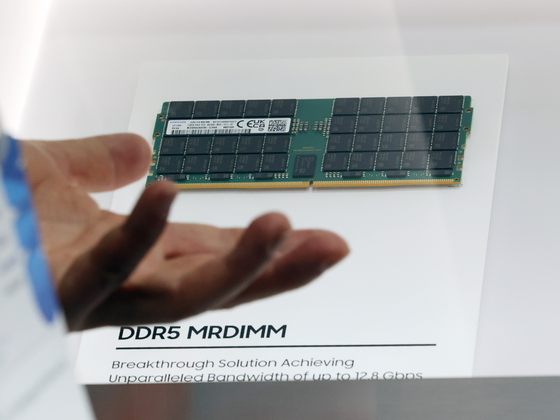

As Samsung Electronics, SK Hynix, and Micron aggressively shift production to server double data rate 5 (DDR5), PC DDR5 and DDR4 supplies are tightening, likely causing a slight bump in PC DRAM prices throughout Q4.

Server DRAM demand is benefiting from renewed expansion momentum among cloud service providers (CSPs), with DDR5 products maintaining their strong position.

Despite proactive capacity adjustments by suppliers, TrendForce highlighted ongoing uncertainties. These include technical issues faced by some suppliers and plans to prioritize sixth-generation HBM (HBM4) production in early 2024, contributing to continued DDR5 supply instability and price increases into Q4.

Low power double data rate 4X (LPDDR4X), common in mid-range smartphones, is projected to see over 10% price growth quarter-over-quarter. While suppliers cut production, device manufacturers are ramping up purchases to avoid supply disruptions. LPDDR5X adoption is expanding beyond premium smartphones, driving sustained price increases.

Graphics DRAM is experiencing robust demand, buoyed by seasonal PC inventory growth and anticipation surrounding Nvidia’s RTX 6000 series. A significant quarter-over-quarter jump in graphics double data rate 7 (GDDR7) prices is anticipated.

Older DDR4 DRAM saw prices double in Q3 as manufacturers stockpiled inventory ahead of major memory companies’ planned discontinuations. However, with set sales failing to show a clear rebound, price increases are expected to moderate in Q4.