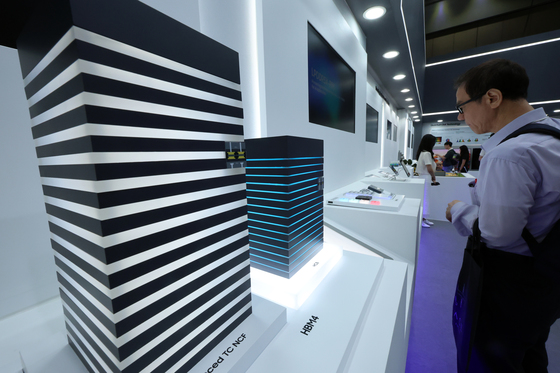

The era of sixth-generation high-bandwidth memory (HBM4), the next-generation artificial intelligence (AI) semiconductor memory, is dawning, intensifying competition among memory chip manufacturers.

Notably, with Samsung Electronics and Micron joining the fray, SK Hynix is expected to face challenges in maintaining its previously held monopoly on HBM4.

While SK Hynix has taken the lead by being the first to complete preparations for HBM4 mass production, Samsung Electronics and Micron are rapidly catching up. Some industry observers predict that, as newcomers to the HBM arena, Samsung and Micron may offer lower prices to secure early entry into Nvidia’s supply chain, potentially triggering a price war.

SK Hynix’s 62% Market Share at Risk; HBM Prices Projected to Fall 8%

According to industry sources on Wednesday, the average selling price (ASP) of HBM is expected to drop 6% to 10% next year compared to this year. This decline is largely attributed to Samsung Electronics and Micron likely undercutting SK Hynix’s prices to gain early access to Nvidia’s supply chain.

Ryu Hyung-geun, an analyst at Daishin Securities, has revised the 2026 HBM ASP forecast from a 7% growth to a 6% decline, taking into account the potential reduction of HBM4 price premiums due to heightened competition.

In a July report, Goldman Sachs predicted that intensifying supplier competition would lead to a 10% drop in HBM prices next year, shifting pricing power from manufacturers to customers such as Nvidia.

If Samsung Electronics and Micron engage in price competition, SK Hynix’s long-held monopoly is likely to diminish.

Nvidia plans to incorporate HBM4 into its next-generation AI accelerator, Rubin, and is expected to establish a multi-vendor system starting with HBM4. While NVIDIA relied almost exclusively on SK Hynix for its HBM3E supply, it aims to diversify its suppliers with HBM4.

As latecomers, both Samsung Electronics and Micron are prioritizing market share gains, even at the expense of profit margins.

An industry insider stated that it can’t afford to repeat past failures where it couldn’t even enter the market. Further stating that starting from zero, even a slight dip in current profitability is still a net positive for them.

SK Hynix Aims to Maintain Leadership with a First-Mover Advantage in Mass Production

As the HBM4 era unfolds amid intensifying competition, SK Hynix retains its leading position.

SK Hynix shipped the industry’s first HBM4 samples in March and has now completed mass production preparations, giving it an advantage in customer qualification tests.

SK Hynix’s HBM4 doubles the number of data transmission channels (I/O) to 2,048, enhancing bandwidth twofold while improving power efficiency by over 40%. This product can boost AI service performance by up to 69% when integrated into customer systems.

Moreover, it achieves operational speeds exceeding 10 Gbps, surpassing the JEDEC standard of 8 Gbps for HBM4. By leveraging its proven advanced MR-MUF process and 5th generation (1bnm) dynamic random access memory (DRAM) technology, SK Hynix has minimized mass production risks.

Jo Joo-hwan, SK Hynix’s Vice President overseeing HBM development, stated that the completion of HBM4 development marks a new milestone in the industry. Further, it will meet customer demands for performance, energy efficiency, and reliability with timely product delivery, securing the competitive edge in the AI memory market and achieving rapid market penetration.

Samsung Electronics Confident in Its Performance, Targets Early Entry into NVIDIA’s Supply Chain

As a challenger, Samsung Electronics aims to secure early access to Nvidia’s HBM4 supply chain, banking on superior performance.

Samsung Electronics’ HBM4 uses its foundry’s 4nm process for the logic die and 1c DRAM for the core die. This approach is intended to showcase superior technology compared to SK Hynix, which employs a 12nm process for its logic die and 1b DRAM.

Given that finer processes significantly enhance memory performance, Samsung could seize a crucial opportunity if it realizes its mass production plans within the year.

However, Samsung Electronics must overcome the challenge of improving yield rates. Reports indicate that the yield rate for Samsung’s 1c DRAM has improved to 50%, but it needs to reach 70% for profitability.

An industry insider noted that the feedback on Samsung Electronics’ HBM4 samples sent to customers appears positive. Further adding that while it’s too early to make definitive predictions, early entry into NVIDIA’s supply chain is certainly within reach.