In August, Hyundai Motor Group’s average transaction price (ATP) in the U.S. reached a yearly high, exceeding 39,000 USD. This surge is largely driven by robust sales of higher-priced vehicles, particularly hybrid electric vehicles (HEVs). However, some industry experts suggest that efforts to curb price hikes through reduced incentives and streamlined production may have reached their limit since the 25% tariff was implemented in April.

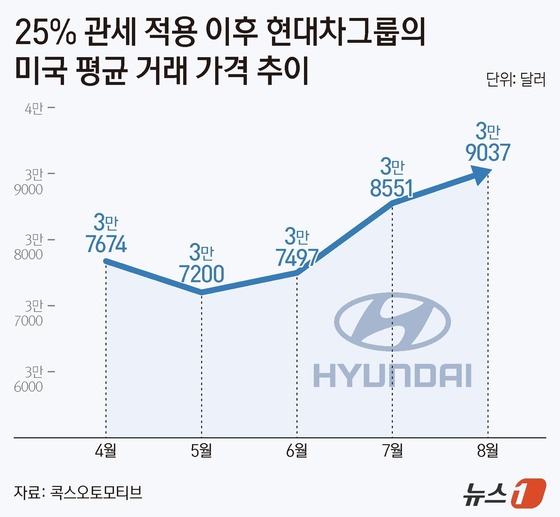

Cox Automotive, a leading automotive market research firm, reports that Hyundai Motor Group’s ATP for August reached 39,037 USD, marking a 1.3% increase from July.

This figure represents the highest monthly ATP of the year, showing a 3.6% jump from April when the 25% tariff on imported vehicles was first imposed. In dollar terms, this translates to a 1,363 USD increase.

Unlike the manufacturer’s suggested retail price (MSRP), the ATP reflects the actual average price paid by consumers in the market, taking into account incentives, discounts, and fees.

Hyundai Motor Group’s ATP increase outpaced the industry average. While U.S. automakers saw their ATP rise by 0.5% to 49,077 USD in August, Hyundai Motor Group’s increase since April was more than four times the industry’s average uptick of 0.8%.

In contrast, rival Toyota Group’s ATP in August dipped by 1.1% to 45,164 USD from April’s 45,667 USD.

Breaking down Hyundai Motor Group’s August ATP by brand: Hyundai reached 38,218 USD, Kia achieved 37,443 USD, and Genesis topped 64,766 USD. Both Hyundai Motor Group and Kia set new yearly highs, while Genesis recorded its highest price in four months.

Hyundai (including Genesis) and Kia set a new monthly sales record in August, moving 179,455 units. Eco-friendly vehicles, particularly HEVs, drove this growth by accounting for 27.9% of total sales with 49,996 units sold. HEV sales skyrocketed by 59.1% year-over-year to 33,894 units, while electric vehicle sales hit a monthly record of 16,102 units.

Experts suggest that the ability to absorb tariff costs has reached its limit. Since April, the U.S. government has imposed a 25% tariff on imported vehicles.

Hyundai and Kia have managed to minimize tariff-induced price hikes by leveraging inventory and expanding local production. However, as inventories dwindle four months post-tariff implementation, maintaining price stability has become increasingly challenging. Since April, the automakers have implemented minor price increases of less than 200 USD on some model year changes, but have avoided significant hikes attributed to tariffs.

In late July, the Korean government reached an agreement with the U.S. to reduce the automotive tariff from 25% to 15%. However, implementation has stalled due to unresolved differences in negotiation details. Japan, which finalized similar negotiations about a week before Korea, accepted most U.S. demands, resulting in a reduction of their automotive tariff to 15% as of Tuesday.