The global cryptocurrency market rebounded as the U.S. government’s record-breaking 43-day shutdown came to an end. Bitcoin and major altcoins saw simultaneous gains, with XRP notably surging over 7% in less than a day, buoyed by anticipation of a potential spot exchange-traded fund (ETF) launch.

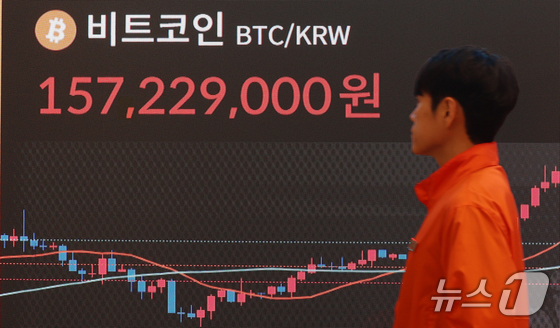

At 4:54 p.m. on Thursday, Bitcoin was trading at 103,493 USD globally, according to CoinMarketCap. This represents a more than 2% recovery from the price dip earlier that morning around 5:00 a.m., when uncertainty loomed over the impending shutdown vote.

Altcoins also joined the upward trend. During the same period, Ethereum (ETH) climbed 3.64% to 3,534 USD. Binance Coin (BNB) and Dogecoin (DOGE) followed suit with gains of 1.47% and 4.77%, respectively.

XRP emerged as the standout performer among major altcoins. Trading at 2.49 USD, it posted a 7.14% increase since the morning, marking the most substantial rise among the top 10 cryptocurrencies by market capitalization.

The afternoon resurgence in the crypto market can be attributed to the resolution of the U.S. government shutdown. Reuters reported that on the evening of January 12, President Donald Trump signed the temporary budget bill passed by the House of Representatives.

This action officially ended the 43-day shutdown that began in October, setting a new record for the longest government closure in U.S. history. The resolution of this prolonged economic uncertainty appears to have reinvigorated investor confidence in risk assets like cryptocurrencies.

XRP’s notable price surge is largely attributed to heightened expectations for spot ETF approval in the wake of the shutdown’s conclusion.

On Monday, asset management firm Canari Capital filed an 8-A form with the U.S. Securities and Exchange Commission (SEC) for the launch of an XRP spot ETF. This form is typically submitted just before an ETF is set to begin trading on an exchange.

Bloomberg ETF analyst Eric Balchunas projected that the inaugural XRP spot ETF could potentially launch as early as Thursday.

Should the XRP spot ETF receive approval for listing, it would become the fourth asset among the top 10 cryptocurrencies by market cap to secure ETF approval. This follows the recent listing of a Solana (SOL) spot ETF with staking functionality on the Nasdaq at the end of the previous month, which garnered significant market attention.