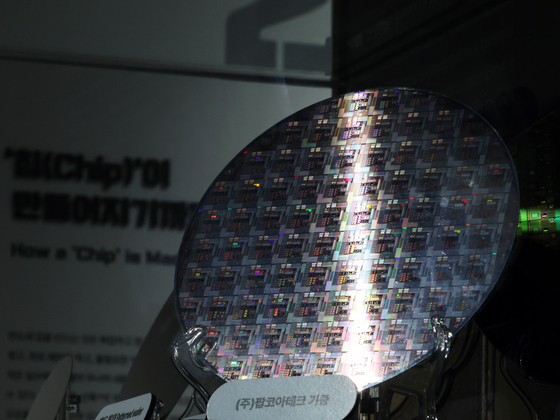

Despite the positive outlook for South Korea’s economy, which is expected to rebound to around 2% growth this year on the back of a semiconductor boom, the foreign exchange market remains skeptical.

The phenomenon of South Korea’s economy growing more slowly than the U.S. for four consecutive years has become a structural factor weighing on the won’s value.

Experts caution that without fundamental reforms to boost potential growth rates, it will be challenging to resolve exchange rate instability beyond short-term supply-and-demand measures.

According to the Ministry of Economy and Finance, the government revised its economic growth forecast for this year to around 2.0% on Wednesday.

This 0.2 percentage point increase from previous estimates reflects robust semiconductor exports driven by global expansion in AI investment and a recovery in consumer spending. Major institutions, including the International Monetary Fund (IMF), have also highlighted potential upside for the Korean economy, projecting growth of 1.9% to 2.1%.

The concern is that despite this recovery, the growth gap with the United States is widening.

The IMF has upgraded its U.S. growth forecast to 2.4%, while major global investment banks predict U.S. growth will outpace South Korea’s at around 2.3%.

If these projections hold true, South Korea will have recorded lower growth rates than the U.S. for four consecutive years from 2023 through this year.

Market analysts argue that this reversal in growth rates is driving more than just numerical differences, spurring actual capital flows.

Countries with higher growth rates typically attract more global funds due to expectations of stronger corporate performance and asset returns, suggesting that South Korea’s investment appeal is diminishing by comparison.

Indeed, the expansion of overseas investments by individual Korean investors, dubbed Western stock ants, has become a key factor in the won’s depreciation.

According to the Korea Securities Depository, net purchases of U.S. stocks by these investors surpassed $3.2 billion in just over two weeks in January, already exceeding the total purchases for the previous month.

Kim Jeong Sik, an emeritus professor of economics at Yonsei University, explained that the surge in investments flowing into the U.S. stock market has been driven by expectations of high returns amid strong growth rates. He added that, to strengthen policy credibility and curb capital outflows, South Korea should maintain consistency in its laws and regulations governing real estate and stocks.

Experts unanimously agree that stabilizing the exchange rate requires overhauling the growth engine itself.

Woo Seok Jin, a professor of economics at Myongji University, argues that strengthening economic fundamentals will restore Korea’s investment appeal and alleviate exchange rate pressure caused by the U.S. stock market frenzy. Kim Sang-bong, a professor at Hansung University, emphasizes that efforts to nurture future industries, such as artificial intelligence (AI) and quantum computing, must precede any expectations of long-term exchange rate stability.

Proactive management of external risks remains a challenge.

Joo Won, head of research at the Hyundai Economic Research Institute, warned that U.S. government tariff policies and other external factors remain major variables. Kim Tae-bong, a professor of economics at Ajou University, also cautioned that continued pressure should be expected during actual tariff negotiations, adding that recent U.S. government statements on semiconductors could pose significant risks to the South Korean economy.