First Eagle Investment, a U.S. asset management firm, still views the Korean stock market as attractively priced despite its record-breaking rally.

On Wednesday, Bloomberg reported that Christian Heck, a portfolio manager at First Eagle, cited the rapid pace of Korean market reforms as a reason for optimism, noting that Korea is bypassing Japan’s trial-and-error phase. He remarked that Korea is learning from Japan’s successes and accelerating its timeline.

Heck observed that while Japan took a decade to enhance corporate governance, Korea is achieving faster results by learning from Japan’s experiences. He believes Korea has already reached the inflection point that Japan hit in 2023.

The value-up program, tied to President Lee Jae-myung’s pledge to raise the KOSPI 5000, is being implemented more aggressively and swiftly in the market than Japan’s past medium- to long-term reforms.

Japan’s TOPIX index surged 25% in 2023 as corporate governance reforms took hold, followed by gains of 18.2% in 2024 and 14.5% in 2025, marking three consecutive years of robust growth. This success, the result of Japan’s decade-long market stimulus efforts, has led to expectations that the KOSPI will follow a similar trajectory at an even faster pace.

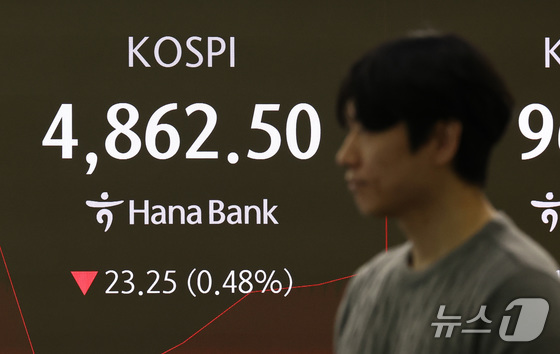

Bloomberg highlighted the KOSPI’s exceptional performance from 2025 through January 2026. The index soared 76% last year and has already climbed another 16% this year, making it the world’s highest-returning index.

Despite this, the KOSPI’s forward price-to-book (P/B) ratio remains at 1.5 times, which is still 9% below the TOPIX’s. Heck sees this as an indication that the KOSPI has room to rise further.

However, he cautioned that the rally’s narrow focus on semiconductors and artificial intelligence (AI), coupled with limited participation from domestic retail investors, poses potential risks.

First Eagle, headquartered in New York, manages approximately $176 billion in assets. As a foreign institution with nearly three decades of experience investing in the Korean market, it has recently been drawing positive comparisons between Korea’s corporate governance improvements and value-up policies and Japan’s success story.