Despite the impact of U.S. tariffs, South Korea’s three major tire companies are expected to have performed well last year. This resilience is attributed to their consistent high growth in Europe, their largest market, and stabilized raw material and transportation costs. The companies have also offset the burden of U.S. tariffs by raising local selling prices.

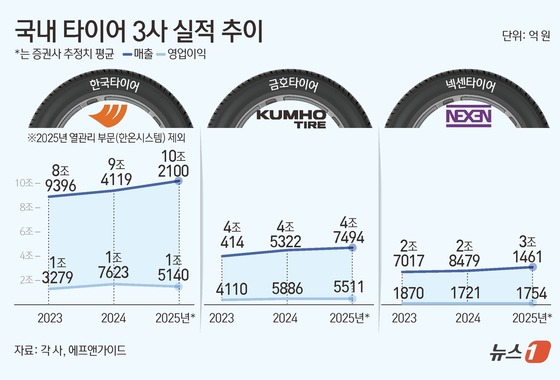

Financial data provider FnGuide reports that the combined sales consensus for Hankook Tire & Technology (excluding Hanon Systems), Kumho Tire, and Nexen Tire is projected to reach 18.1055 trillion KRW (about 12.3 billion USD) for last year, a 7.8% increase from the previous year. This puts all three companies on track for record-breaking sales in both 2024 and 2025.

Hankook Tire’s tire division alone is estimated to have generated sales of 10.210 trillion KRW (about 6.95 billion USD), an 8.5% year-over-year increase. Kumho Tire is expected to see a 4.8% rise to 4.7494 trillion KRW (about 3.23 billion USD), while Nexen Tire anticipates a 10.5% jump to 3.1461 trillion KRW (about 2.14 billion USD).

However, operating profits are projected to decline for two of the three companies. Hankook Tire’s tire division is expected to see a 14.1% decrease in operating profit to 1.5140 trillion KRW (about 1.03 billion USD), while Kumho Tire’s is forecast to drop 6.4% to 551.1 billion KRW (about 375.2 million USD). Nexen Tire, on the other hand, is estimated to post a 1.9% increase in operating profit to 175.4 billion KRW (about 119.4 million USD).

The decline in operating profits, despite record-high sales, is largely due to the 25% tariff on auto parts imposed by the Donald Trump administration last May. In the third quarter alone, the three tire companies reportedly incurred a combined tariff cost of approximately 115 billion KRW (about 78.3 million USD), with Hankook Tire bearing 60 billion KRW (about 40.8 million USD), Kumho Tire 30 billion KRW (about 20.4 million USD), and Nexen Tire 25 billion KRW (about 17 million USD).

Two Decades of European Market Focus Serves as a Buffer Against U.S. Tariffs; Rubber Prices and Shipping Costs Remain Stable

Despite the high U.S. tariffs, industry analysts note that the companies have managed to protect their operating profits better than initially feared at the start of last year.

In response to the tariffs, the three companies raised their U.S. selling prices in the third quarter, with Hankook Tire increasing prices by 5-10%, Kumho Tire by 7%, and Nexen Tire by 7-8%.

Hankook Tire completed its Tennessee plant expansion at the end of last year and plans to boost annual production by 5 million tires this year, aiming to increase its local procurement rate from 25% to 50%.

Lim Eun-young, an analyst at Samsung Securities, stated that the impact of U.S. tariffs has been offset by the reduction in tariff rates and the increased local production capacity from the Tennessee plant expansion.

The tire industry’s largest global market remains Europe, which has helped shield the companies from the full impact of U.S. tariffs. As of 2024, Europe accounts for 42% of Hankook Tire’s tire sales, compared to just 21% for North America. Similarly, Nexen Tire’s European sales proportion is 40%, outpacing its North American share of 24%. Industry analysts estimate that European sales represented about 45% of Hankook Tire’s revenue and 42% of Nexen Tire’s revenue last year.

An industry insider noted that since the late 2000s, the three tire companies have aggressively increased their supply of original equipment (OE) tires to premium European automakers. The recent growth in Europe’s electric vehicle (EV) market has also boosted high-margin OE sales for tires capable of handling the increased weight of EVs.

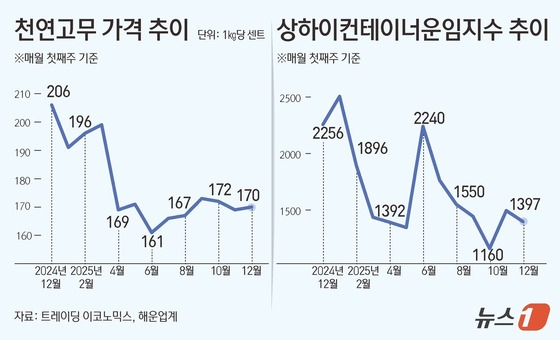

The stabilization of raw material prices and shipping costs has also helped minimize the decline in operating profits. According to market research firm Trading Economics, natural rubber prices, which traded at 2.06 USD per kilogram in early December 2024, fell to between 1.6 USD and 1.7 USD cents in the latter half of last year. The Shanghai Containerized Freight Index (SCFI), which reflects global maritime shipping rates, also dropped from the 2200s to the 1300s over the course of a year.