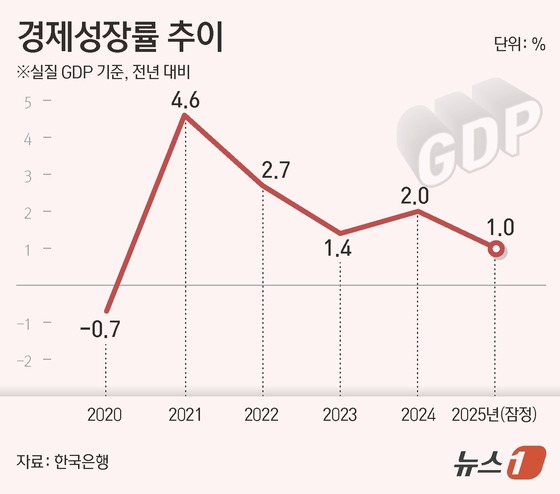

Last year, the Korean economy barely managed to achieve a 1.0% growth rate. This is not only the lowest level since the negative growth in 2020 but also a poor performance compared to major advanced countries such as the U.S. and Japan.

The low growth rate was largely due to a combination of domestic and external shocks, including political instability caused by martial law and impeachment proceedings at the beginning of the year, as well as the tariff storm from the U.S. However, some argue that it also revealed the limitations of a growth structure that relies heavily on exports amid weak domestic demand.

The government is confident about returning to 2% growth this year. While a numerical rebound may be possible due to base effects, experts warn that it will be difficult to escape the low-growth trap without structural improvements through labor and corporate regulatory reforms.

Political Instability, Tariff Storm, and Weak Demand… Lowest Growth Among Major Countries

According to the Bank of Korea on Thursday, Korea’s annual real gross domestic product (GDP) growth rate for last year was estimated at 1.0% (preliminary). This figure is only half of the potential growth rate (around 2.0%), which represents the basic strength of our economy.

Compared to major global economies, it’s among the lowest performances. According to the IMF’s World Economic Outlook released on Monday, the global economy is estimated to have grown by an average of 3.3% last year. The average growth rate for advanced economies reached 1.7%.

The U.S., which enjoyed a lone boom based on robust consumption despite prolonged high interest rates, grew by 2.1%. Even Japan, stuck in a low-growth trap, outpaced Korea with 1.1% growth. China recorded a 5% growth rate last year despite weak domestic demand.

Most of the G7 countries, including the Eurozone (1.4%), the United Kingdom (1.4%), and Canada (1.6%), recorded higher growth rates than Korea.

The decisive blow that closed the growth plate was the slump in construction investment. Last year, construction investment plummeted by 9.9% compared to the previous year, recording the worst decline since the 1998 financial crisis (-13.2%). This was due to a series of delayed groundbreakings caused by high interest rates, soaring construction costs, and concerns about real estate project financing (PF) insolvency.

According to the Bank of Korea’s analysis, the contribution of construction investment to growth was -1.4 percentage points. Calculations show that if construction investment had just maintained the previous year’s level (0%) without eroding growth, the economy could have grown by 2.4%.

Lee Dong-won, Director of Economic Statistics at the Bank of Korea, explained that the construction sector significantly constrained overall growth, largely due to delayed groundbreakings caused by conflicts over construction cost increases.

The economy was primarily sustained by semiconductors. Exports increased by 4.1% last year, driven by strong semiconductor performance. The contribution of net exports (exports minus imports) to growth was 0.3 percentage points, while semiconductor exports contributed 0.9 percentage points. In effect, semiconductors prevented the Korean economy from collapsing.

Private consumption increased by 1.3%, slightly improving from the previous year (1.1%), but the recovery pace remained slow.

Government Optimistic About 2% Growth Return This Year… Experts Warn of Limited Potential Growth Rate Rebound Without Regulatory Improvements in Labor and Other Areas

The government views last year’s 1% growth rate as a result of multiple domestic and external adversities and predicts that the spark for economic recovery will continue this year. In the first half of last year, economic sentiment was dampened by the aftermath of the December 3 martial law incident that occurred at the end of 2024. In the fourth quarter (-0.3% negative growth), temporary factors such as changes in U.S. tariff policies, reduced working days due to the Chuseok holiday in October, and the fire at the National Information Resources Service converged.

Kim Jae-hoon, Director General of Economic Policy at the Ministry of Economy and Finance, stated that excluding the political shock in the first quarter and temporary factors in the fourth quarter, the economy is on a recovery path, growing by 1.7% in the second half of the year. With exports remaining robust and improved corporate performance leading to increased household income, it expects growth of around 2.0%, close to the potential growth rate, this year.

The government particularly anticipates that the improving trend in the semiconductor industry will continue this year, and domestic demand will also revive as the effects of early fiscal execution materialize. The fact that real Gross Domestic Income (GDI) increased by 0.8% quarter-on-quarter in the fourth quarter, surpassing the GDP growth rate, was interpreted as a positive signal supporting future consumption capacity.

However, there are still numerous variables. Risk factors such as inflationary pressures due to a weak won, potential slowdown in the semiconductor cycle, and tariff pressure from the U.S. remain. While this year’s performance may improve due to the base effect from last year’s poor showing, some argue that it’s insufficient to reverse the declining trend in potential growth rate.

Experts emphasize the urgency of strengthening industrial competitiveness and reforming corporate regulations. They argue that without creating a business environment that aligns with global standards, a rebound in the potential growth rate will remain elusive. In particular, they expressed concern that recent government policies such as the Yellow Envelope Law (amended Trade Union and Labor Relations Adjustment Act), the introduction of the Worker Presumption System, and the Commercial Act amendment could dampen corporate investment sentiment.

Kim Jung-sik, Professor Emeritus of Economics at Yonsei University, stated that while achieving 2% growth is not impossible due to the base effect from last year’s 1% growth and continued strong semiconductor exports in the second half, it’s not easy to raise the potential growth rate. Except for semiconductors and automobiles, its main industries like petrochemicals and steel are losing ground to China.

Professor Kim added that while major countries are growing by attracting corporate investment, policies that don’t align with global standards, like them, will inevitably lead to capital outflow. It’s urgent to strengthen industrial competitiveness by creating an environment conducive to corporate investment, including labor market flexibility.