Hyundai Motor and Kia are poised to surpass a combined revenue of 300 trillion KRW (about 207 billion USD) last year, setting a new record for their highest performance to date. However, the impact of U.S. tariffs is expected to reduce their annual operating profit by nearly 20% compared to the previous year, bringing it down to around 21 trillion KRW (about 14.5 billion USD). Looking ahead, Hyundai and Kia anticipate a recovery in operating profit this year, projecting an increase of over 9% to more than 23 trillion KRW (about 15.9 billion USD), thanks to a 15% reduction in tariffs and expanded sales of high-value vehicle models.

Hyundai Motor to Report Q4 Earnings on January 29, Kia on January 28… Annual Revenue Expected to Top 300 Trillion KRW for the First Time

According to the Financial Supervisory Service’s electronic disclosure system (DART) on January 25, both automakers are set to unveil their fourth-quarter financial results on these dates.

Wall Street analysts estimate that Hyundai and Kia will report fourth-quarter revenues of 48.18 trillion KRW (about 33.3 billion USD) and 28.51 trillion KRW (about 19.7 billion USD), respectively, totaling 76.69 trillion KRW (about 53 billion USD). This represents a 4.0% increase from the same period last year. Operating profits are projected at 2.66 trillion KRW (about 1.8 billion USD) for Hyundai and 1.89 trillion KRW (about 1.3 billion USD) for Kia, combining for a total of 4.55 trillion KRW (about 3.1 billion USD). This figure reflects a 17.8% year-over-year decrease, with Kia expected to see a steeper decline (-30.4%) compared to Hyundai (-5.7%).

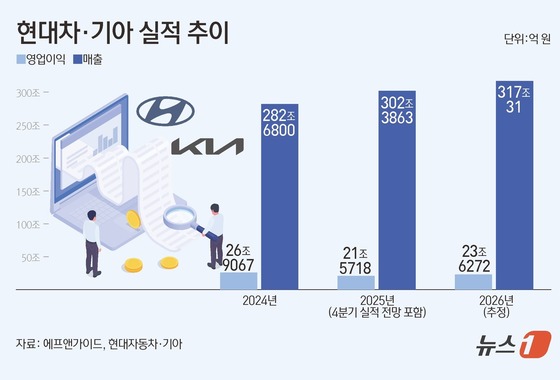

Factoring in these fourth-quarter estimates, Hyundai and Kia’s annual revenues and operating profits for last year are projected to reach 302.39 trillion KRW (about 208.8 billion USD) and 21.57 trillion KRW (about 14.9 billion USD), respectively. The annual revenue is set to increase by 7% compared to the previous year, breaking the 300 trillion KRW (about 207 billion USD) barrier for the first time and setting a new record. The previous revenue peak was approximately 282 trillion KRW (about 194.7 billion USD) in 2024.

Despite achieving record-breaking revenues, the annual operating profit is estimated to decline by nearly 20%. This downturn is primarily attributed to the hefty 25% U.S. tariff implemented last April. Hyundai reported an operating profit loss of about 2.6 trillion KRW (about 1.8 billion USD) due to these tariffs during the second and third quarters (April to September). Kia also incurred a similar loss of around 2 trillion KRW (about 1.38 billion USD).

Although the U.S. tariff was reduced to 15% last November, analysts believe the impact of tariff-related losses will persist into the fourth quarter, largely due to existing inventory levels. Lee Sang-soo, an analyst at iM Securities, explained that a significant portion of the U.S. inventory consists of vehicles imported before the tariff reduction, so the benefits of the lower tariff are expected to materialize starting in the first quarter of 2026.

With Easing U.S. Tariffs and Higher Sales of High-Value Models, Revenue Is Forecast at 317 Trillion KRW and Operating Profit at 23.6 Trillion KRW This Year

Industry analysts predict that Hyundai and Kia’s performance will rebound in 2026, driven by easing tariffs in their largest market, the U.S., and an uptick in global sales.

Current analyst estimates for 2026 project combined revenue of 317.03 trillion KRW (about 218.9 billion USD) and operating profits of 23.63 trillion KRW (about 16.3 billion USD). Revenue is expected to continue breaking records, with operating profits forecasted to increase by 9.5% compared to last year.

For the current year, Hyundai and Kia have set ambitious sales targets of 4,158,300 and 3,350,000 vehicles, respectively. Their combined sales goal of approximately 7.5 million units represents an increase of over 200,000 units from last year’s figure of 7,273,983.

The automakers are expected to maintain their double-digit market share in the U.S., their largest market. Last year, Hyundai and Kia sold over 1.83 million vehicles in the U.S., achieving a record market share of 11.3%. This upward trend is likely to continue, particularly with the expansion of high-margin large SUVs and eco-friendly vehicles, which are set to bolster their overall performance.

Lee noted that Hyundai’s performance is poised for improvement this year, driven by a more favorable product mix from increased sales of the Palisade and Genesis models in the U.S., a rebound in the Indian market, the impact of new vehicle launches, and reduced tariff burdens following the confirmation of the 15% rate.

Park Kwang-rae, an analyst at Shinhan Investment Corp, stated that Kia is set to tackle demand slowdowns head-on by introducing new models like the Telluride and Seltos in the U.S., along with the commencement of Sportage production at the Meta plant in the second quarter. The new sport utility vehicle (SUV) model cycle in the U.S. and the expansion of the electric vehicle lineup in Europe will be key drivers of profit growth.