GC Biopharma Corp has broken its chronic fourth-quarter deficit cycle, thanks to the successful launch of its immunodeficiency treatment drug ALYGLO in the U.S. market. The company achieved a fourth-quarter profit for the first time in eight years by expanding exports of high-margin products. Industry experts predict that ALYGLO’s demonstrated profitability, combined with improved subsidiary management efficiency, will lead to a significant performance rally starting in 2026.

Fourth-Quarter Jinx Broken as ALYGLO Surpasses 100 Million USD in Annual Revenue

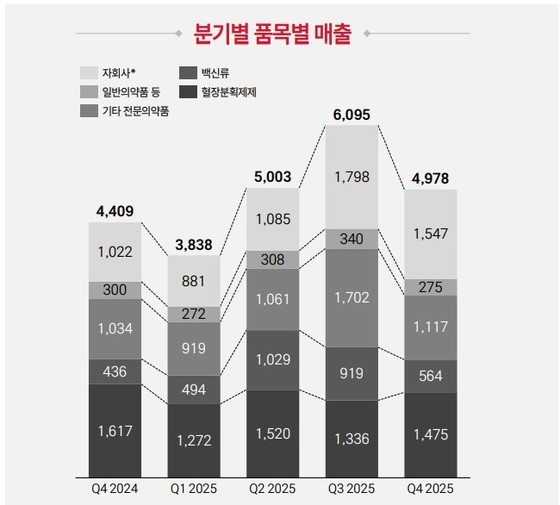

According to industry reports on Wednesday, GC’s preliminary consolidated revenue for the fourth quarter of last year reached 497.8 billion KRW (342.9 million USD), marking a 12.9% increase compared to the same period last year. The company recorded an operating profit of 4.6 billion KRW (about 3.17 million USD), successfully turning a profit. This figure exceeded the earnings forecast of 1.1 billion KRW (757,600 USD), resulting in a positive earnings surprise.

ALYGLO was the main driver behind this performance rebound. In the fourth quarter alone, ALYGLO generated consolidated sales of 50 million USD, demonstrating rapid growth. This represents a remarkable increase of 38.9% year-over-year and 92.3% from the previous quarter.

ALYGLO’s total annual revenue last year reached 106 million USD, surpassing the company’s earlier target of 100 million USD. By the end of the first half of the year, the cumulative number of patients treated exceeded 500. The total patient count for last year is expected to surpass 1,000.

ALYGLO received product approval from the U.S. Food and Drug Administration (FDA) in December 2023. This intravenous immunoglobulin 10% drug is used to treat primary immunodeficiency diseases.

ALYGLO is manufactured using GC’s proprietary Cation Exchange (CEX) Chromatography method, which minimizes the detection of impurities such as coagulation factor (FXIa), offering superior safety compared to existing drugs.

The successful entry of ALYGLO into the U.S. market is attributed to its product competitiveness and GC’s effective local vertical integration channel strategy.

GC has secured contracts with major U.S. insurers and pharmacy benefit managers (PBMs), including Cigna Healthcare and UnitedHealth Group, aggressively ensuring insurance coverage from the outset of its market entry.

Heo Eun-cheol, Chief Executive Officer (CEO) of GC, stated that ALYGLO will be remembered as a successful case of a domestically produced biopharmaceutical entering the U.S. market, adding that it will continue our efforts to expand treatment options and improve accessibility for patients and healthcare providers in the U.S.

ALYGLO Sales Expected to Stabilize at 100 Million USD; Impurity Minimization to be Proven

GC aims to make this year a cornerstone for maximizing profitability. The core strategy focuses on expanding ALYGLO prescriptions through aggressive marketing and enhancing the performance of its subsidiary ABO Holdings.

GC expects ALYGLO to achieve stable annual revenue of 100 million USD this year. The company plans to increase product reliability by publishing research papers on impurity minimization processes and completing clinical trials for pediatric patients, while ramping up marketing efforts.

In 2027, the company will pursue the publication of safety research papers based on real-world evidence (RWE) and seek approval changes to expand the age range for pediatric use. By 2028, GC aims to achieve over 90% coverage in the U.S. private insurance market and targets annual revenue of 300 million USD.

The company plans to further enhance the profitability of its U.S. subsidiary, ABO Holdings, which is responsible for supplying raw materials for blood products.

Earlier this year, GC completed the vertical integration from plasma procurement to production and sales by acquiring ABO Holdings. All six blood centers operated by ABO Holdings have received FDA approval. Additional approval for the Laredo center in Texas is anticipated in the first half of this year. As the operational rate of blood centers increases and plasma collection rises, the burden of fixed costs will decrease, contributing to improved consolidated performance.

Seo Geun-hee, a researcher at Samsung Securities, stated that in 2026, ALYGLO sales are expected to grow by 46.8% year-over-year to 217.8 billion KRW (about 150 million USD), leading overall company growth. It anticipates a reassessment of corporate value due to reduced losses from major subsidiaries and an increased share of high-margin products.