Last month, the Consumer Price Index (CPI) met market expectations and, as jobless claims reached a four-year high, widespread anticipation grew that the Federal Reserve (the Fed) would implement a 0.25 percentage point rate cut at the September Federal Open Market Committee (FOMC) meeting, triggering a broad rally in U.S. stocks.

On Thursday, The Dow Jones Industrial Average surged 1.36%, while the S&P 500 and Nasdaq Composite climbed 0.85% and 0.72%, respectively. The Dow’s robust performance likely reflects a rebound from its recent underperformance.

This upswing propelled all three major indices to new record highs.

The latest CPI report revealed that while inflation met market expectations last month, it continues to show persistent signs.

Headline CPI increased 0.4% month-over-month (MoM) and 2.9% year-over-year (YoY). Although the annual increase aligned with forecasts, the monthly figure exceeded the anticipated 0.3% rise.

For context, July saw increases of 0.2% and 2.7%, respectively.

Core CPI, which excludes volatile food and energy prices, rose 0.3% MoM and 3.1% YoY, both in line with market projections.

While overall inflation met expectations, it still demonstrates stubborn underlying pressures.

However, these figures are unlikely to derail the Fed’s plans for a rate cut, though they may have dashed hopes for a more aggressive 0.5 percentage point reduction.

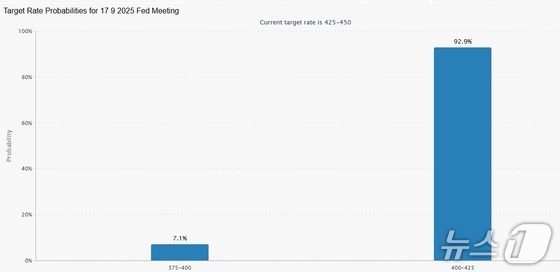

Currently, futures trading on the Chicago Mercantile Exchange (CME) indicates only a 7.1% probability of a 0.5 percentage point cut, down from 12% the previous day.

Conversely, the odds of a 0.25 percentage point cut have risen to 92.9%, up from 88% just a day earlier.

These shifts suggest that the Fed is increasingly likely to opt for a 0.25 percentage point rate cut at its September 16-17 FOMC meeting.

Adding to the dovish sentiment, the latest weekly jobless claims hit 263,000—the highest level in four years—further bolstering the case for monetary easing.

Expectations of the rate cut buoyed most major tech stocks.

Tesla stood out with a surge of over 6%, leading a broader rally among electric vehicle stocks.

In the semiconductor sector, Nvidia edged down 0.08%, but Micron Technology jumped 7.55%, helping to push the overall semiconductor index up 0.63% at the close.

Meanwhile, Oracle Corporation, which had spearheaded the previous day’s market rally, retreated 6.27% as investors locked in profits following its recent sharp gains.