In a groundbreaking development, SK Hynix has outpaced Samsung Electronics to claim the top spot in global memory sales for the second quarter of this year.

Market research firm Counterpoint Research (Counterpoint) reported on Thursday that SK Hynix recorded memory sales of 21.8 trillion KRW (about 15.6 billion USD), narrowly surpassing Samsung Electronics’ 21.2 trillion KRW (about 15.1 billion USD). This marks a historic first for SK Hynix in the memory market.

This achievement follows SK Hynix’s earlier milestone of leading the Dynamic Random Access Memory (DRAM) market for the first time in the first quarter of this year, according to the same agency.

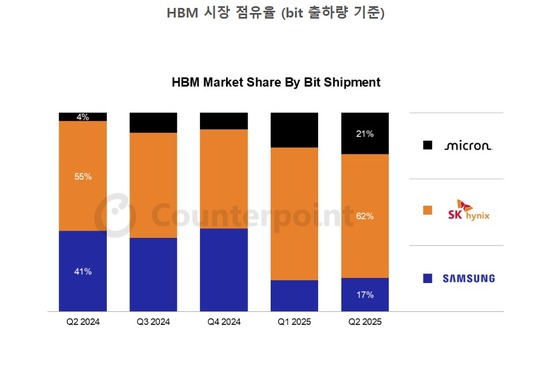

Counterpoint analysts point to Samsung’s struggles in the high-bandwidth memory (HBM) sector as a key factor in this shift. Samsung’s HBM market share, measured by bit shipments, plummeted from 41% to 17% year-over-year in the second quarter. This decline is largely attributed to the previous U.S. administration’s export restrictions to China, which significantly impacted HBM sales channels.

Meanwhile, SK Hynix saw its market share climb from 55% to 62% during the same period. By ramping up its supply of cutting-edge products to Nvidia, the leading HBM consumer, SK Hynix achieved a record-breaking operating profit of 9.2129 trillion KRW (about 6.58 billion USD) in the second quarter.

Choi Jeong-gu, a senior analyst at Counterpoint, offered insight into Samsung Electronics’ performance that the silver lining for Samsung Electronics is that its HBM sales have begun to rebound in the second quarter after bottoming out in Q1. He emphasized that to reclaim lost market share, Samsung Electronics must diversify its sales channels for the fifth-generation HBM (HBM3E) and successfully pass Nvidia’s stringent quality tests.

Choi further noted that to secure orders for the sixth-generation HBM (HBM4) in Nvidia’s next-gen chipset Rubin, Samsung Electronics must meet high-quality standards and achieve satisfactory yield rates. He added that given Samsung Foundry’s recent success in winning Tesla’s business, there’s reason to be optimistic about Samsung Electronics’ overall performance going forward.